‘World’s Hardest Money’ Gets Harder

Bitcoin Mining Difficulty Sets New ATH, Crossing 50T for First Time

On Wednesday, Bitcoin underwent a difficulty increase that brought its mining difficulty to the highest level ever:

#bitcoin mining difficulty hit a new all-time high yesterday and has been in an uptrend since July ’21 as miners have continued to come online throughout $BTC's downturn:

h/t @coingecko & @mempool pic.twitter.com/LPJFsO7XLC

— Osprey Funds (@OspreyFunds) June 1, 2023

Mining difficulty measures the average number of hashes, or guesses, needed to be attempted to solve for the nonce, or correct answer that solves the proof-of-work algorithm. Surpassing a difficulty of 50 trillion, on the average block miners must attempt, currently 51.2 trillion, hashes to arrive at the correct hash, thus allowing another block to be added to the Bitcoin blockchain. Bitcoin mining companies have continued to bolster their mining capabilities throughout the downturn in BTC’s price. The most recent news came on Thursday when American Bitcoin mining company, CleanSpark, announced they would be adding 12,500 new mining units for a purchase price of $40.5 million:

Hot off the press! More miners have been purchased by $CLSK for lower than the current average market price. Approximately 12,500 Antminer S19 XP units were bought for $40.5 million – or $23 per terahash.

The units have a power-efficiency rating of 21.5 joules per terahash… pic.twitter.com/TKRxhWXlzx

— CleanSpark Inc. (@CleanSpark_Inc) June 1, 2023

Bitcoin mining stocks are commonly seen as a leveraged play on the price of Bitcoin. This has proven true so far this year as BTC is up ~62% whereas the Valkyrie Bitcoin Miners ETF (WGMI), which holds ~20 Bitcoin mining and mining related firms, is up nearly 140%:

Additional bullish news for the Bitcoin mining industry came this week in the form of the agreement on the United States debt ceiling. The Biden administration was trying to include the Digital Asset Mining Energy (DAME) excise tax which would impose a 30% tax on crypto mining companies. The DAME tax ended up being scrapped in the debt ceiling agreement between House Speaker Kevin McCarthy and President Joe Biden, which is now sitting before the Senate.

New Bill Could Give Reasonably “Decentralized” Crypto Assets Commodity Status

Now, sticking in the realm of United States politics, we will segue to a new discussion draft of legislation pertaining to crypto which was released on Friday. The currently unnamed bill was announced in a press release by the Financial Services Committee and is being spearheaded by Patrick McHenry, Chairman of the House Financial Services Committee, Glenn Thompson, Chairman of the House Committee on Agriculture, French Hill, Chairman of the Subcommittee on Digital Assets, Financial Technology and Inclusion, and Dusty Johnson, Chairman of the Subcommittee on Commodity Markets, Digital Assets, and Rural Development:

#NEW: Chairman @PatrickMcHenry & @RepFrenchHill release a digital asset market structure proposal with @HouseAgGOP Chairman @CongressmanGT & @RepDustyJohnson in an unprecedented joint effort to provide clarity to the digital asset ecosystem.

Read more:https://t.co/089dV2SYng pic.twitter.com/pSIIVjfslU

— Financial Services GOP (@FinancialCmte) June 2, 2023

In recent months there have been ongoing debates about whether crypto assets should fall under the category of securities or commodities which would place them under the purview of the SEC or CFTC, respectively. The draft outlines definitions of sufficient decentralization, which, if met, would allow crypto assets to be deemed commodities. If the SEC believes the standards of decentralization are not met however, they must provide a detailed analysis on why they believe that in an attempt to have the asset deemed a security.

Many in the crypto space have been frustrated with the lack of regulatory clarity for crypto in the United States and the large number of actions taken against crypto firms in recent months, primarily by the SEC. Early reactions from the industry to the proposed legislation have been generally positive, including from Polygon Chief Policy Officer, Rebecca Rettig, who stated, “The draft bill creates a starting point to ensure a robust framework for the industry, which will help ensure the U.S. remains competitive in allowing blockchain technology to be built here”. Although the bill is still in draft form, Chairman Patrick McHenry said he “encourage[s] the public to provide constructive feedback to help [them] get this right”.

GameStop Enters Partnership with a Web3 Gaming Firm

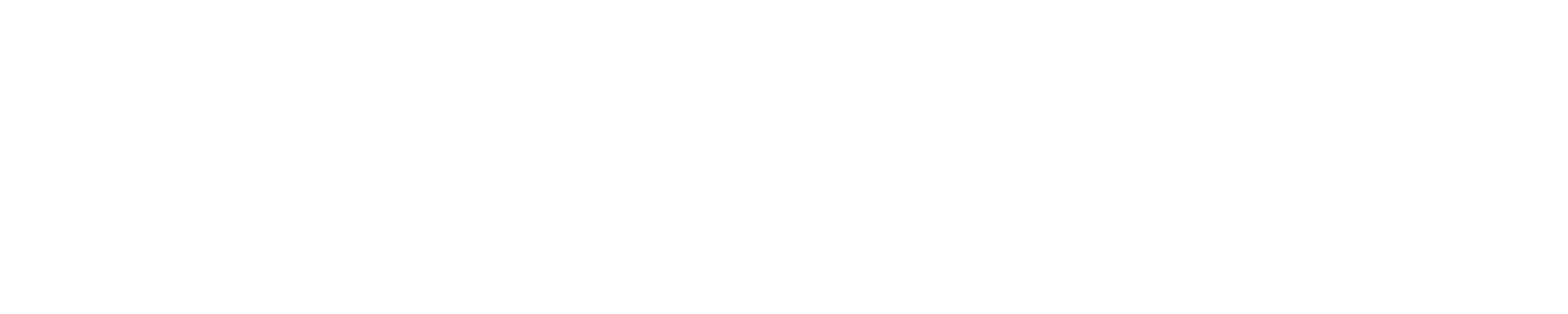

Gaming has long been seen as a potential use case for blockchain technology. Putting gaming assets on-chain allows users to have digital ownership of those assets. Games with on-chain assets such as Axie Infinity, Otherdeed for Otherside, and God’s Unchained have shown promise with high dollar volumes in the past, but have not seen the staying power that many games on platforms like Xbox, PlayStation, or Nintendo enjoy. On-chain gaming assets are typically issued as non-fungible tokens (NFTs). Ark Invest predicts that the NFT space will grow more than 5x from ~$22 billion in transaction volume in 2022 to ~$120 billion by 2027 in their “Big Ideas 2023” report. The firm believes that decentralized proof-of-ownership, which NFTs allow for, will greatly increase online spending per capita:

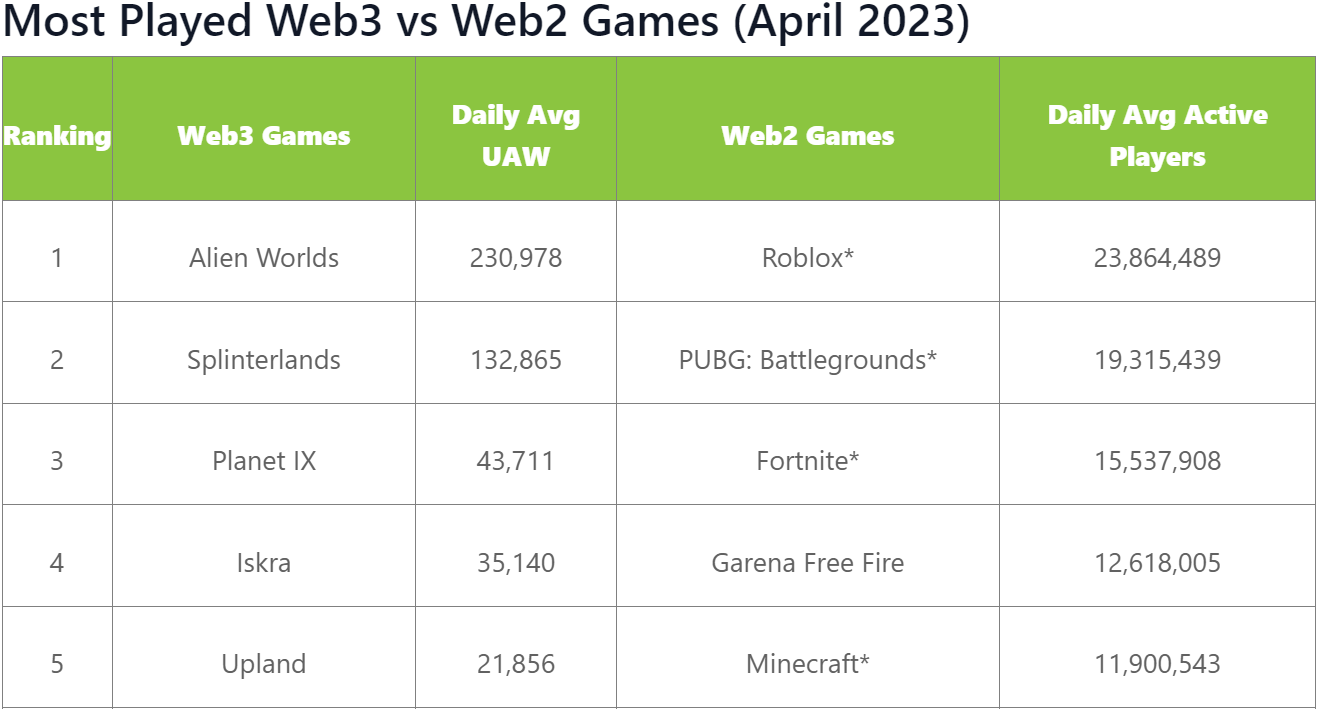

On Thursday, Web3 gaming company, Telos, announced a partnership with GameStop in an attempt to launch more high quality Web3 games going forward. The upcoming games will be compatible with the Telos blockchain and distributed through GameStop’s new game launcher, GameStop Playr. The partnership has hopes to bridge the currently massive chasm between Web2 and Web3 gaming, which CoinGecko highlighted in a recent research report:

ICYMI:

USDT Market Cap Hits All-Time High of $83.2 Billion

BTC Futures ETF Underperforms BTC Due to Contango Bleed

MakerDAO Purchases an Additional $1.28 Billion in U.S. Treasuries

New Legal Brief Labels Tornado Cash Sanctions as “Unprecedented and Unlawful”

Before We Go:

May has seen the 5th most monthly DeFi users ever and most since Dec. ‘21:

h/t @richardchen39 pic.twitter.com/Oae4jus7wr

— Osprey Funds (@OspreyFunds) May 31, 2023