Weekend Recap: The Acronym Edition

This week we dive into crypto’s favorite acronyms — CEXs, DEXs, DeFi, and CBDCs

J.P. Morgan Reiterates Centralized Players Are to Blame, Not DeFi

The FTX/Alameda fiasco has emboldened crypto skeptics in recent days but banking giant J.P. Morgan, along with countless others, have homed in on the fact that “the recent collapses in the crypto ecosystem have been from centralized players and not from decentralized protocols”. In fact, JPMorgan executed their first ever DeFi trade a few weeks ago where they used a permissioned pool through AAVE on the Polygon blockchain.

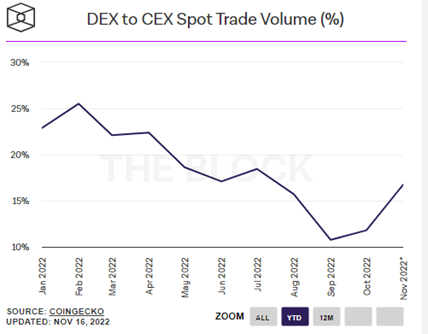

Decentralized exchanges (DEXs) have begun to claw back market share from centralized exchanges (CEXs) in the last few weeks. The percentage of DEX to CEX volume has increased ~6% from September’s low. This can be seen as a flight to safety as decentralized exchanges allow customers to maintain custody of their crypto while exchanging assets.

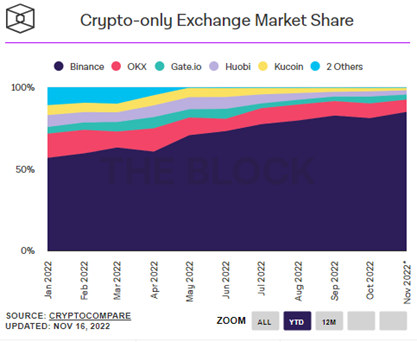

Binance Continues to Grow Market Share

Even with growing uncertainty in CEXs, Binance has continued to gain market share. Among crypto-only exchanges Binance has captured nearly 85% of the market, up from 57% at the beginning of the year. Through the recent downturn Binance continues to show signs of strength such as sharing wallet balances prior to releasing an audited proof-of-reserves in coming weeks, spinning up a crypto “recovery fund” to help fundamentally strong projects that have been adversely affected by current market conditions, and announcing a bid to acquire the insolvent crypto lender, Voyager Digital.

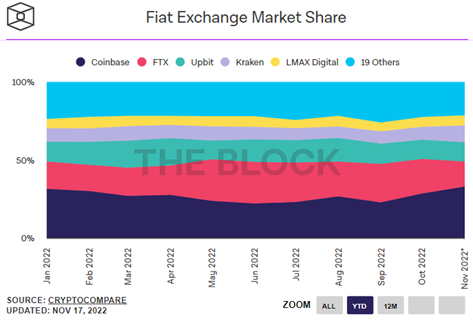

On the fiat exchange front, Coinbase has reiterated that they do not lend out customer assets and can guarantee liquidity because all assets are backed 1:1. The U.S.-based exchange has seen an increase in market share in recent months as many investors see Coinbase as a safer and more strictly regulated exchange than some of their offshore competitors. Coinbase now commands 33% of the fiat exchange market share, up from 23% in September.

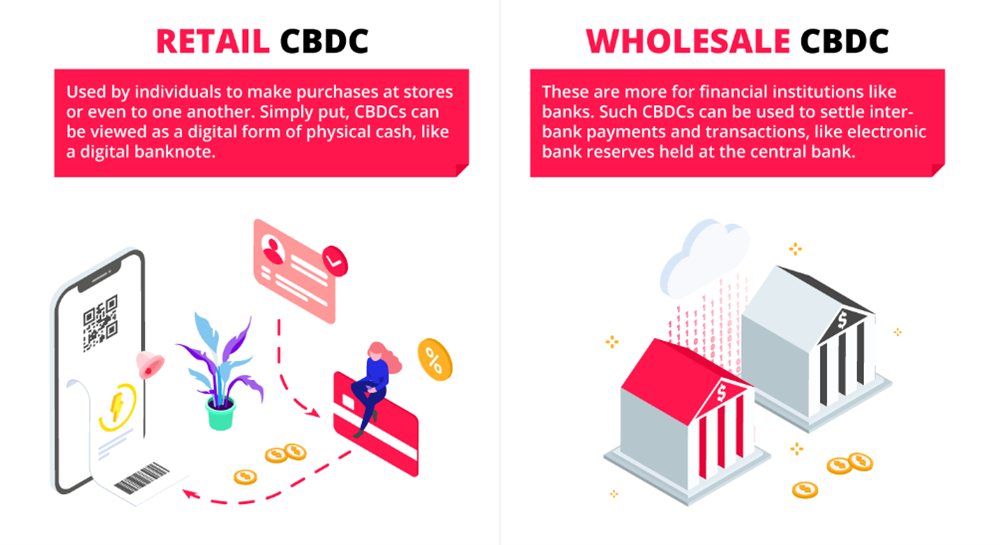

The NY Fed Joins Forces with Major Banks to Test Digital Dollar

The Federal Reserve Bank of New York has entered a 12-week pilot program with Citigroup, HSBC, BNY Mellon, Wells Fargo, and Mastercard to test the use of blockchain technology for settlement of digital dollars between a central bank and other institutions. Also known as central bank digital currencies or CBDCs, they are digital versions of fiat currencies issued by central banks and are being explored by several other monetary authorities including the Eurozone. In the case of this trial program, “wholesale” CBDCs will be issued to reflect customer deposits and settled on a central bank reserve using a shared distributed ledger. The goal of the program is to increase the speed of clearing and settlement processes.

The impact of CBDCs is a hotly debated topic in crypto. While digital dollars could reduce fees and increase speed in the process of currency transactions, it could do so at the cost of privacy. The digital nature of CBDCs also makes them programmable, giving centralized issuers control over the network.

ICYMI:

What Happens When Crypto Meets Ted Lasso

Trading in crypto derivatives surges as investors hedge positions after FTX shock

Cardano-Based Regulated Stablecoin USDA Will Hit the Market in Early 2023

NFT Marketplace X2Y2 Will Enforce Creator Royalties After Pushback

Before We Go:

Ethereum ICO Whale Moves 500 ETH After 7 Years of Hibernation