Don’t Sweat It, Nobody Else Knows What’s Going On Either

There’s a handful of people who really understand crypto and only a fraction of them are sharing knowledge publicly.

So don’t sweat it if you don’t really get some things yet or if it seems like, the minute you understand one component, there are two new things you need to know. It’s like the mythical hydra – you cut off one head and two regrow.

Things have gotten complicated and change is accelerating. The landscape will look different three months from now and different again two months after that.

We’re in the early stages of a revolution that has profound effects across and between multiple modes including:

- Technology

- Macro to Personal Economics

- Society and Culture

- Law and Ownership

- Creativity, Art, and Music

- Politics and Diplomacy

- Energy Consumption

- More Big Things I Haven’t Considered Yet

Keeping track of the technology alone requires high intelligence and expertise before we even begin to integrate it into the fabric of the rest of the list above and the rate of change.

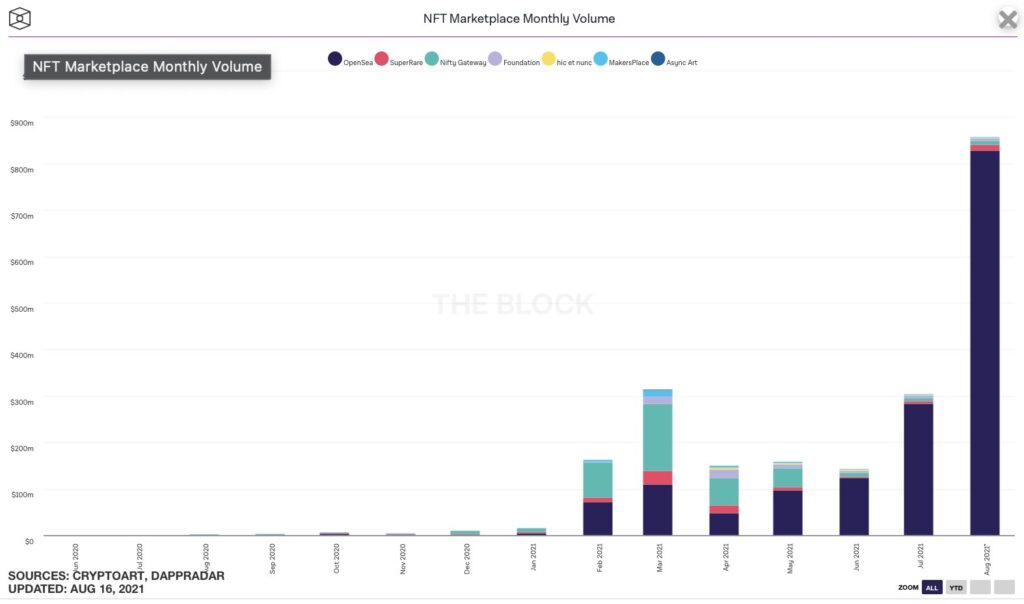

Most recently, NFTs are exploding even as we were just getting a handle on DeFi. It’s NFT Summer.

Here’s a chart The Block’s News Director, Frank Chaparro, shared showing the recent explosion in NFT Marketplace Volume.

Those getting involved range from neophytes, who want to own a cool jpeg, to traders chasing price to those who are deeply immersed in the communities to long-time, wealthy crypto investors to the artists themselves.

Here are a few things to keep in mind as you get involved with risk capital in NFTs or in the broader crypto space given the limits to our understanding.

- As mentioned already, very few people understand fully what’s occurring or know where we’re heading and the landscape will change rapidly and then change again.

- Assets will remain volatile so work that into risk management/tolerance models prior to investing.

- Price momentum drives interest and there is a positive feedback loop component. Asset prices often overshoot.

- Price momentum can also overshoot to the downside.

- Price resilience might be a great tell over longer periods of time. Pay attention to assets that recover.

- Over the long-term, the quality of the asset is critically important.

- Cognitive flexibility is a competitive advantage. Those who are able to hold competing ideas in their heads or change their opinion based on new data might have an advantage.

- Most of what you’re reading, especially in the mainstream media, is dated at best and nonsense at worst.

Stay sharp out there.