DeFi <--> U.S. Treasuries

Maple Finance to Allow Investors to Earn Yield Through U.S. Treasuries

Maple Finance hosted a community call on Tuesday where Co-Founder and CEO, Sidney Powell, announced the platform is preparing to launch a new lending pool. The new pool will give accredited investors and foreign corporate treasuries the ability to earn yield on their stablecoins by investing the pool’s assets in U.S. Treasury bonds. Maple Finance is a lending platform, founded in 2019, that seeks to provide “the infrastructure for credit experts to run on-chain lending businesses and connects institutional lenders and borrowers” (Maple Finance Whitepaper). At the time of writing, according to Maple’s website, the platform has facilitated nearly $2 billion in loans.

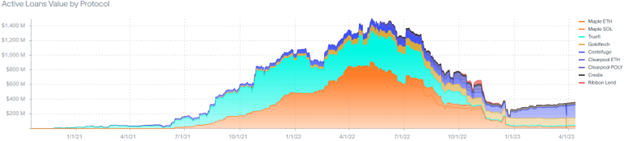

2022 was a tough year for lending platforms as many borrowers went insolvent due to extreme market conditions. Maple was not left unscathed and suffered ~$36 million of credit defaults when borrower, Orthogonal Trading, allegedly misrepresented its financials to hide losses in the aftermath of FTX’s implosion in November ’22, resulting in large losses for lenders. According to data from rwa.xyz, which tracks “Private Credit on DeFi Rails”, active loans on real world asset lending protocols are well off their nearly $1.5 billion peak in May ’22 but have rallied off their December ’22 trough of ~$175 million to ~$360 million as of 4/12:

Powell believes that their upcoming U.S. Treasury pool will garner demand because it will give crypto investors yield on “safe” traditional assets without needing to trust a bank, which are no longer being seen as a safe haven by many in the current environment.

NFT Lending Market Showing Adoption

Now let’s pivot away from DeFi lending to NFT lending, which surpassed $1.1 billion in cumulative borrow volume among top lending platforms on Friday:

The NFT lending market has surpassed $1.1B in cumulative borrow volume

h/t @ahkek4 pic.twitter.com/jxRDCybk92

— Osprey Funds (@OspreyFunds) April 14, 2023

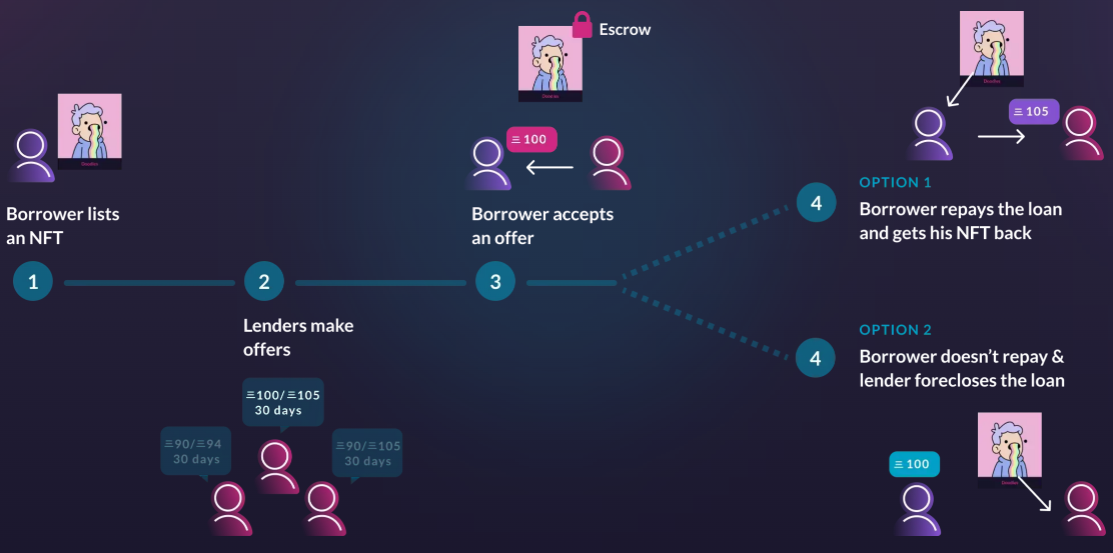

NFT lending platforms allow NFT investors to gain liquidity on their assets without selling their jpegs. NFTfi is the biggest player in the NFT lending space, facilitating nearly $400 million in total loan volume. NFTfi operates as a peer-to-peer lending platform where a borrower lists their NFT and lenders make offers, which the borrower can choose to accept or reject:

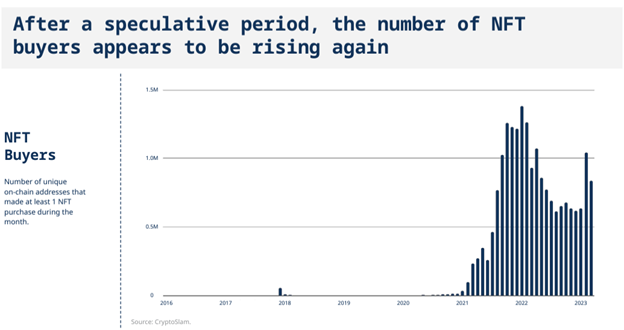

Other NFT lending platforms allow borrowers to borrow a percentage of their NFTs current floor price. For example, BendDAO, allows blue-chip NFT holders to borrow up to 60% of the NFT’s floor price in ETH and charge a cumulative borrow APR of ~11.5%; 27.51% APR paid in ETH – 15.98% APR rewarded in BEND (BendDAO’s native token). The NFT market has recently rebounded off its lows and buyers are appearing to re-enter the market:

Uniswap Gets Green Light From Apple’s App Store

Last month Uniswap Labs, the team behind the world’s largest DEX, Uniswap, announced that Apple was giving them a hard time in regards to getting their Uniswap Wallet app listed on the App Store. But on Thursday, the Uniswap Wallet app broke “out of Apple jail” and went live on the App Store:

1/ THIS IS NOT A DRILL 🔥🔥🔥

The Uniswap mobile wallet is out of Apple jail and now live in most countries 🎉✨

Download our self-custody, open-sourced app today! 👇https://t.co/yWxuw79xTY pic.twitter.com/QhK06icKBL

— Uniswap Labs 🦄 (@Uniswap) April 13, 2023

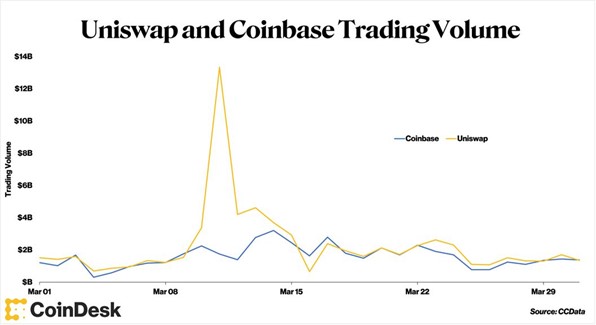

At launch, the Uniswap Wallet app allows users to buy crypto using fiat currencies, trade tokens on the Ethereum, Polygon, Arbitrum, and Optimism networks, and track NFTs (trading NFTs is not enabled yet). This is a big win for Decentralized Exchanges as it greatly increases the ease of adoption through traditional rails that most of the public is more comfortable with. This comes at a time when Uniswap just saw a ~42% greater volume share than Coinbase in March, ~$70 billion for Uniswap and ~$49.2 billion for Coinbase:

ICYMI:

Bankrupt Crypto Exchange FTX has Recovered $7.3 Billion in Assets

Montana ‘Right to Mine’ Crypto Bill Passes the House

Twitter Partners with eToro to Let Users Trade Stocks, Crypto as Musk Pushes App into Finance

U.S. House Committee Publishes Draft Stablecoin Bill

Before We Go:

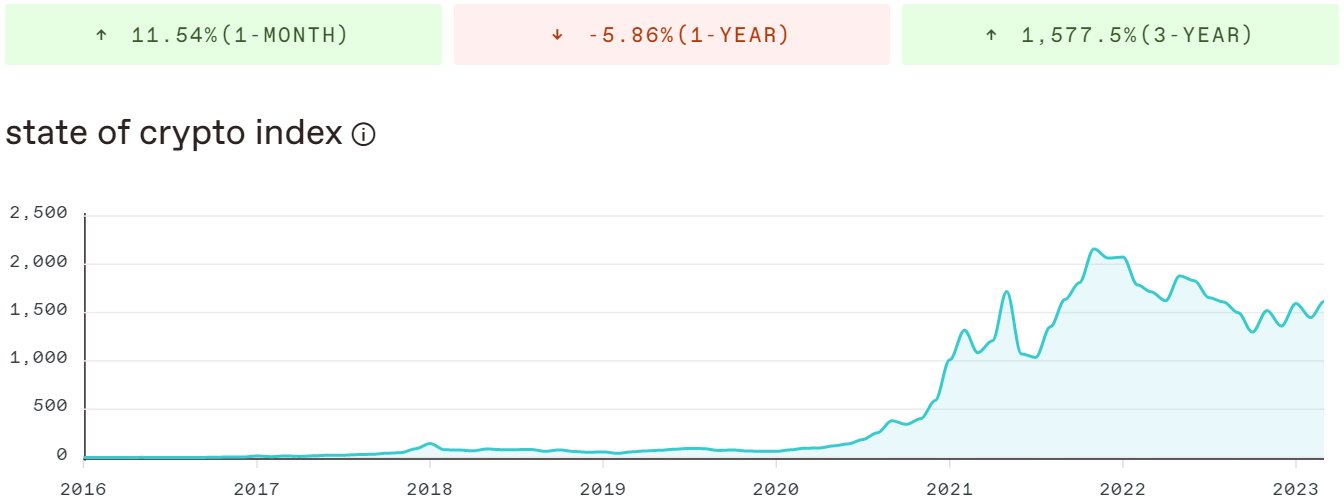

The crypto arm of VC giant Andreessen Horowitz, a16z Crypto, recently released their “State of Crypto Index”. The index tracks factors such as active developers, smart contracts deployed, academic publications, job search interest, and more. Click on the image below to check it out: