Coinbase Goes on the Aggressive Against the SEC

Coinbase Files Lawsuit Against SEC as U.S. Based Crypto Exchanges Begin Looking Offshore

On Monday, Coinbase filed a lawsuit against the Securities and Exchange Commission with a federal appellate court in Philadelphia. Coinbase’s Chief Legal Officer, Paul Grewal, took to Twitter to announce the suit and explain its merit:

Today, we filed a narrow action in the U.S. Circuit Court to compel the SEC to respond “yes or no” to a rulemaking petition we filed with them last July asking them to provide regulatory guidance for the crypto industry. 1/4 https://t.co/rlsS1DIFfl

— paulgrewal.eth (@iampaulgrewal) April 25, 2023

Coinbase filed a petition with the SEC in July ’22 asking the Commission to provide guidance for the crypto industry, which is severely lacking in the current climate. Grewal stated that the “SEC is required by law to respond to petitions ‘within a reasonable time’”, yet they have still not responded to the petition from last July.

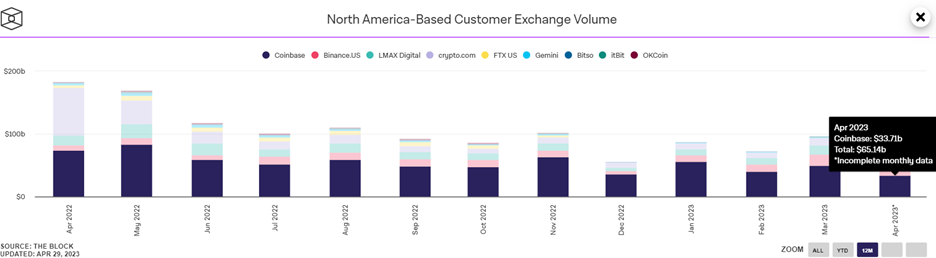

The lack of onshore regulation has been a major source of frustration for crypto companies trying to operate in the United States. Since the beginning of the year, the SEC has issued 14 enforcement actions related to crypto and last week both Coinbase and Gemini announced that they will be spinning up crypto derivatives platforms outside of the United States. Coinbase has been the market share leader among North America-based crypto exchange volume in each month over the past year, currently handling more than 50% of the volume in the region thus far in April:

Flash Crash Causes Mass Liquidations & Wipes Open Interest

Near the end of the traditional trading day on Wednesday there were rumors that Mt. Gox (hold 137.8k BTC) and United States government (hold 69.4k BTC) wallets were effecting Bitcoin transactions. Around the time of the news there was a rapid selloff in crypto, causing ~$310 million of crypto liquidations in a 24 hour period and wiping out ~$1.2 billion of BTC open interest. Arkham Intelligence, the blockchain data company that spurred the rumors mentioned above, released an explanation hours after the flash crash stating the downturn began before the alerts were sent:

We have conducted an investigation of the DB Alert situation, and determined that the Arkham alerts were sent accurately in this case.

DB set two alerts on all Bitcoin transactions above $10k USD, with no counterparties set, then named the alerts “Mt Gox” and “US Gov”.

When we… pic.twitter.com/8OITiygNhL

— Arkham (@ArkhamIntel) April 26, 2023

Eyes have since turned to crypto trading giant, Jump Crypto, which moved ~$26.6 million of BTC to exchanges right before the flash crash. Although the exact reason for the rapid decline is unknown, BTC rallied nearly 10% off the lows in the hours following the crash:

Lightning Payments Becoming Continuously More Mainstream

A few months ago, we explored how Bitcoin’s Lightning Network works and how MicroStrategy, the world’s largest public Bitcoin holder (140,000 BTC), was planning on making it more accessible in 2023. As a refresher, the Lightning Network is a Bitcoin Layer-2 that greatly increases the scalability of Bitcoin, from ~7 transactions per second (TPS) to having the capability to handle ~1 million TPS, and allows for nearly instant BTC transactions with miniscule fees. In more recent news, MicroStrategy’s Executive Chairman, Michael Saylor, announced that the firm had converted corporate email addresses into Lightning addresses:

So @MicroStrategy converted my corporate email address into a #Lightning⚡️ address and people keep sending me 21 sats…🧡 pic.twitter.com/FHde6RtA6N

— Michael Saylor⚡️ (@saylor) April 17, 2023

This implementation allows MicroStrategy employees to use a simple identifier, their emails, to receive and send BTC over the Lightning Network. This announcement came about a week after Coinbase CEO, Brian Armstrong, praised the Bitcoin Layer-2 and said it is something that Coinbase is working on integrating. The implementation of easily identifiable Lightning Addresses, like emails, will likely aid in the adoption of BTC payments on the Lightning Network as they are more user friendly and familiar than traditional Bitcoin wallet addresses.

ICYMI:

What Happens to your Crypto when you Die?

Ex-OpenSeas Manager’s Trial Kicks Off in First NFT Insider Trading Case

Cross River Bank Gets FDIC Enforcement Order Over Lending

Galaxy Digital to Develop ETPs with Asset Manager DWS

Before We Go:

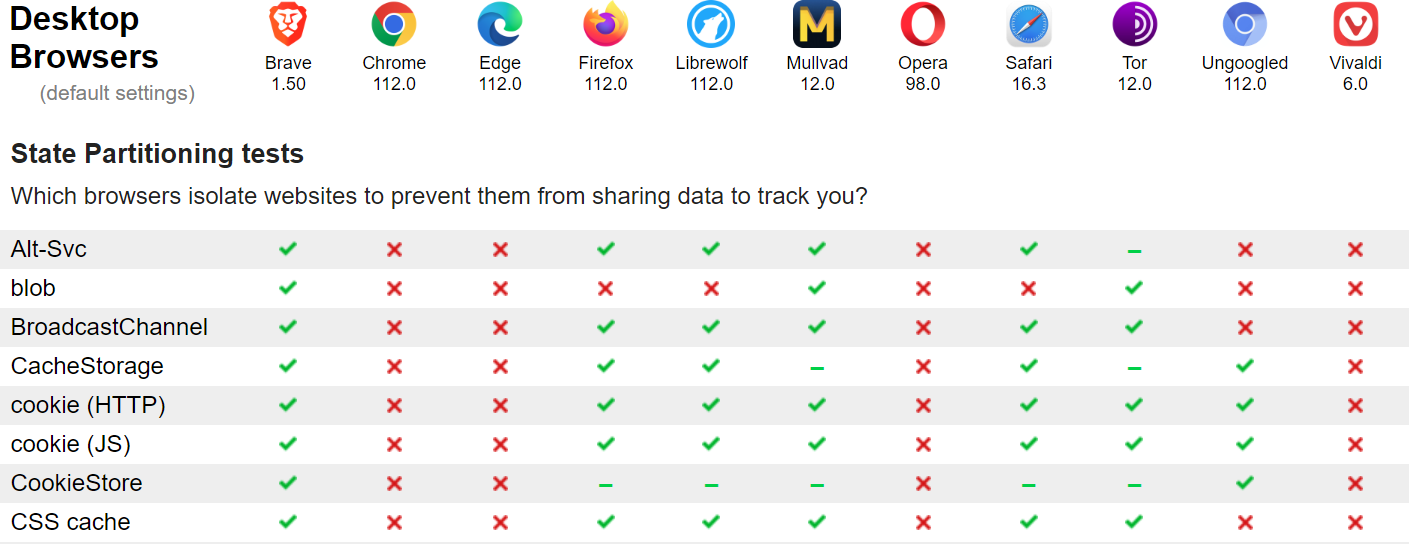

Check out how your browser of choice stacks up at protecting your data on privacytests.org.