What Does Trustless Mean in Crypto?

Blockchains are “trustless” systems.

It’s mentioned all the time, but not well understood so we’re going to break it down concisely.

Transactions Require Trust

Traditional transactions occur through trusted 3rd-party intermediaries like a bank, payment provider, remittance company, credit card provider, etc.

The 3rd-party authenticates and guarantees the transactions, which is great, but there are strings attached.

Often, the intermediary charges a fee and requires detailed information about clients (KYC), thus removing anonymity.

In addition, the intermediary may apply restrictions which affect user experience. For instance, the US banking network is closed ~30% of the year (weekends and holidays). This inconvenience can slow down time-sensitive commerce.

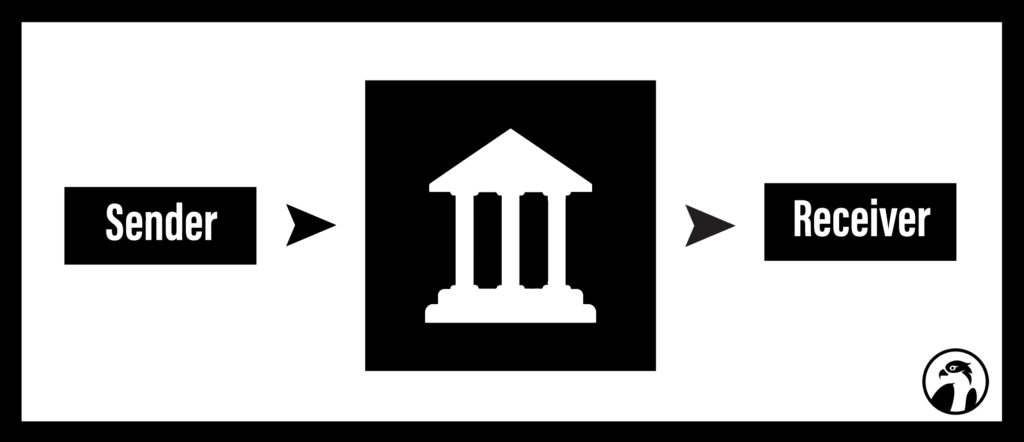

This is what the transaction flow looks like with a financial institution between two parties:

Blockchain removes this trusted 3rd-party so there are no fees, identity demands, time constraints, or other restrictions.

Instead, trust is distributed across multiple nodes on the network.

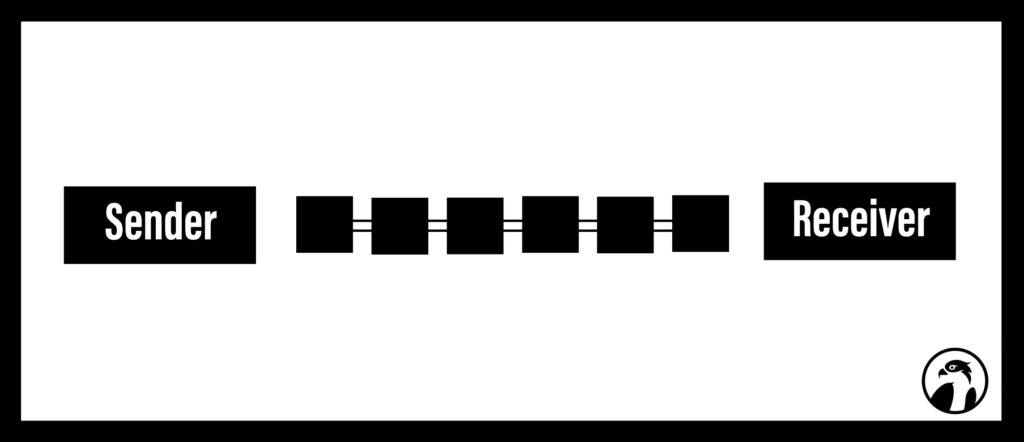

Here is what the flow might look like with blockchain between the two transacting parties:

How Is Trust Distributed Across The Blockchain?

Trust is dispersed across the blockchain through a network of distributed nodes that rely on the strength of cryptographic math to prove ownership instead of relying on one trusted party.

The more numerous and diverse the nodes, the lower the probability that bad actors can collude.

Here’s an example of an early application of this trustless technology.

Recently, Twitter launched a new feature called Tips allowing users to transact on the Lightning Network built on top of Bitcoin at no cost.

Here’s a clip of Jack Mallers sending an instant, free, cross-border payment from Twitter.

Trustless systems have the potential to facilitate commerce on a scale that is an order of magnitude larger than what is available today.

This is the first installment in The Osprey Crypto Made Simple Series where we will describe a concept clearly and concisely. If there’s something you would like us to define, please reply to this Newsletter email or, if you are reading this on the web, hit us directly at riley@ospreyfunds.io.