Zuck’s Smash & Grab

Thursday, Facebook changed its name to Meta in a bold attempt to claim ownership of the Metaverse.

Think what you will, you have to give Zuck credit for identifying a burgeoning megatrend and diving in head first.

He did the same thing with mobile after falling behind there back in 2012 and proceeded to build a dominant suite of apps and targeted ad money generating machine.

Crypto VC Chris Dixon said it best more than a week before the announcement:

It’s not a coincidence that the one web2 giant taking web3 seriously is also the only one that is still founder-led.

It was already a war for the soul of web3 between the establishment/entrenched capitalism and the crazy ones before the name change, but now it’s explicit.

Here’s his opening remarks at Facebooks’ virtual conference. We hate to say it, but it’s a powerful presentation even as the visual representation of the Metaverse seems cartoonish.

Here’s a screenshot:

Facebook filed to change its ticker from $FB to $MVRS, taking effect December 1st.

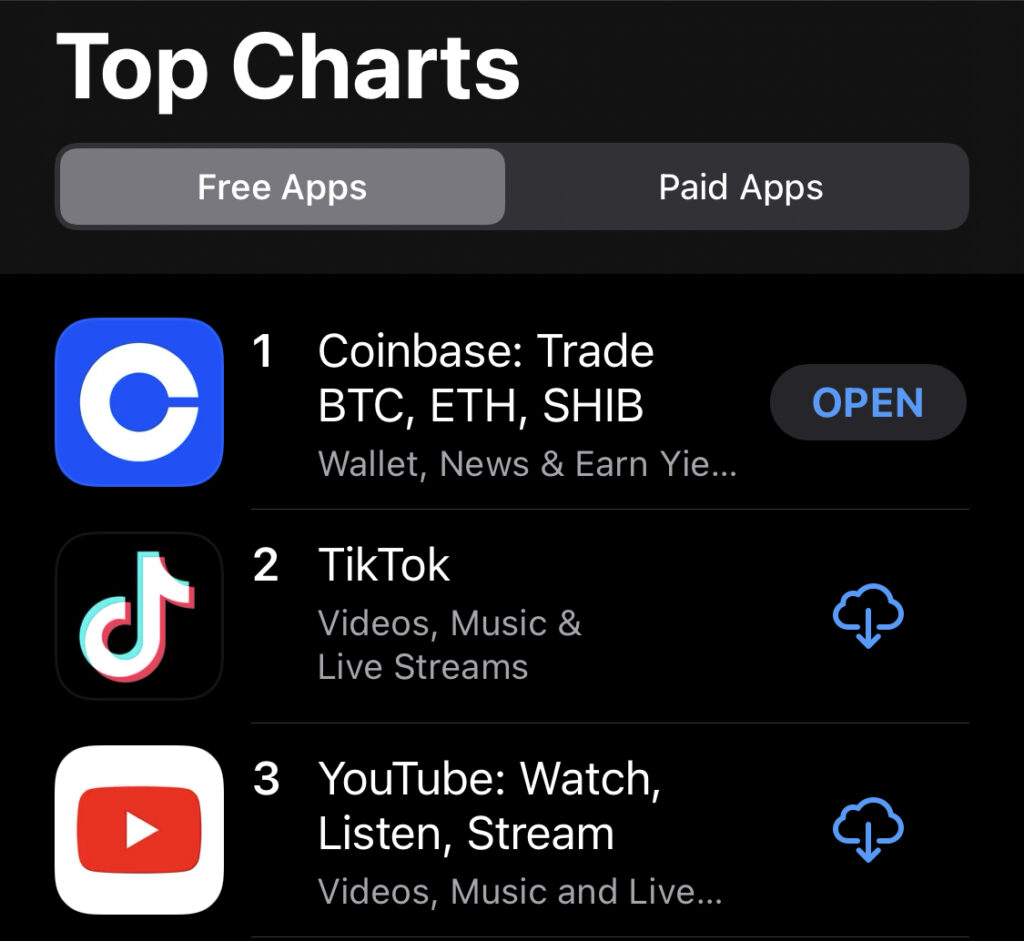

? Coinbase Captures Apple’s Top Spot

Coinbase overtook TikTok and is now the #1 App in Apple’s App Store.

It’s probably nothing —

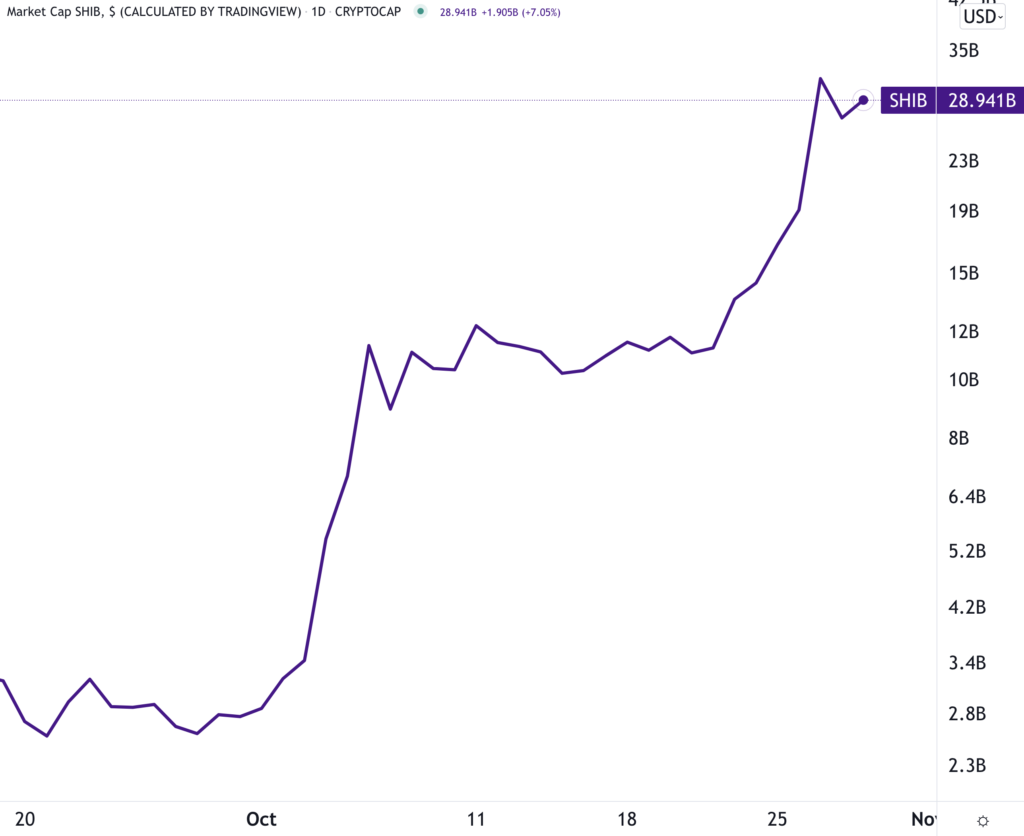

? What The Shiba…

This week, Shiba Inu soared. The dog-coin has risen >900% in October and is now up ~5,800% for 2021.

Coin Telegraph reports that someone has gained 94,278,239.8% on the coin and is now a billionaire after investing a few thousand dollars beginning in August 2020.

The story reminded us of F. Scott Fitzgerald’s famous quote,

The test of a first-rate intelligence is the ability to hold two opposing ideas in mind at the same time and still retain the ability to function.

Yes, SHIB is a joke coin based on another joke coin ($DOGE). And yes, the whole space is totally absurd.

But at the same time, profound technology is being built out in front of our eyes and it is already beginning to change the world.

Both can be true. Crypto is an absurd joke and a profound technological advance.

? A Few Good Reads

The above ^^ is the money quote from Fred Wilson’s excellent post, Web3 vs Web2.

Wilson provides a history lesson with wisdom on the transition from networks to decentralization.

Ethereum designer Richard Burton shared Why Wallets Excite Me Again on the evolution of digital wallets and what’s next.

Humans have an interesting relationship with wallets. This likely won’t go away in the digital days.

John St Capital shared a great read, Chaordic Organizations, Community Investing & the return of the DAO.

Here’s a preview quote:

Following the “human capital” was something done for quite some time, and that used to be Wall Street (e.g., Goldman Sachs, Morgan Stanley, JPM), followed by Big Tech (e.g., Google, Amazon, Facebook, Microsoft), followed by fast growing startups (e.g., Uber, Airbnb) to faster growing startups (e.g., Stripe, Plaid, Coinbase, Robinhood, Doordash), and now into Web3.0 / crypto. These periods of human capital inflows have also corresponded with significant financial capital inflows; all while moving out the risk-curve for both.

? Listen To This…

Chris Dixon and Naval Ravikant recently talked with Tim Ferris about —

- The difference between Web1, Web2, an Web3. (20:20)

- What gives digital assets like altcoins and NFTs value? (41:53)

- You’re not late to the party (yet): decentralization is still in its early days. (1:26:41)

- Decentralizing the American Dream. (1:35:48)

It’s an insightful conversation.

? Pay For Crypto Education With Crypto

The University of Pennsylvania’s Wharton School will accept crypto for it’s new online program, The Economics of Blockchain and Digital Assets.

Kevin Werbach, academic director of the program, shared,

Blockchain and digital assets are not going away. We hope to equip business leaders, consultants, and entrepreneurs to identify the value drivers of these innovative technologies and to give them the practical understanding to build solutions.

The Ivy will accept Bitcoin, Ethereum, and USDC.

? What’s New In NFTs?

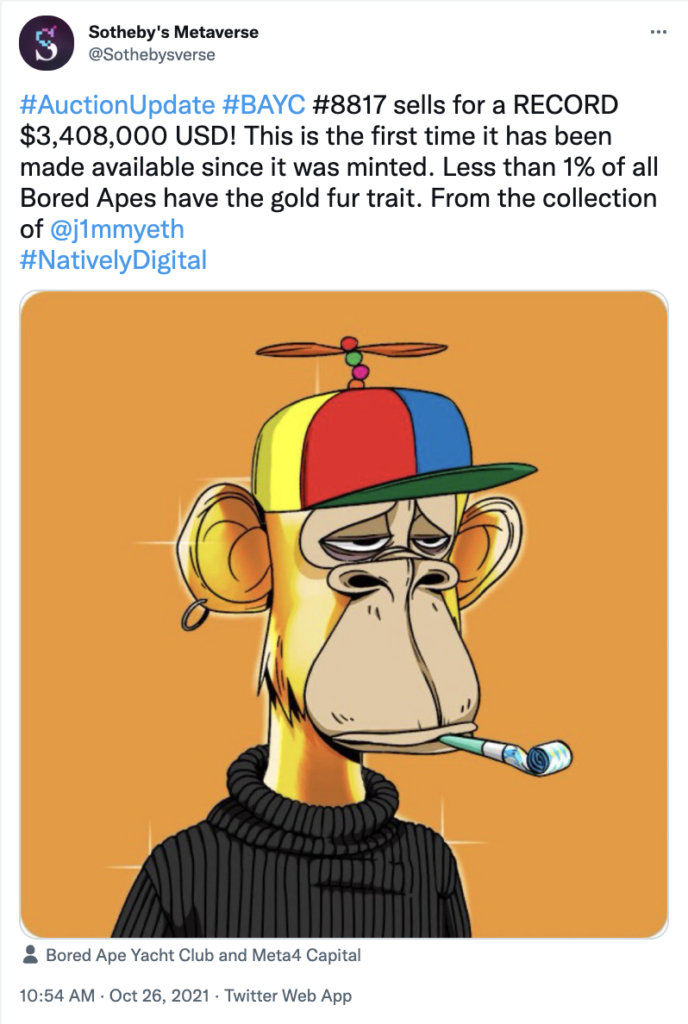

Bored Ape Yacht Club #8817 sold for $3.4M at Sotheby’s, a new all-time high for the NFT collection.

The auction house tweeted:

Twitter turned into a frenzy on Thursday night after Punk 9998 was sold for ~$530,000,000.

According to the blockchain, the NFT was “sold,” but it never changed hands.

Larva Labs, creator of the Punks clarified,

PSA: This transaction (and a number of others) are not a bug or an exploit, they are being done with “Flash Loans.” In a nutshell, someone bought this punk from themself with borrowed money and repaid the loan in the same transaction.

Some recent large bids were done the same way. The ether is offered and removed in a single transaction. So, while technically briefly valid, the bid can never be accepted. We’ll add filtering to avoid generating notifications for these kinds of transactions in the future.

Adobe announced Content Credentials, a new way to provide and assess digital content provenance and attribution.

The company partnered with NFT marketplaces; KnownOrgin, OpenSea, Rarible, and SuperRare to show potential buyers if the wallet used to create the digital asset was the same one used to mint.

Hot Wheels unveiled its NFT Garage to bring the fan-favorite physical-collectible into the digital world.

Users can purchase a mystery pack of 4 or 10 NFTs. They’ll be able to connect or trade their findings while a select few may be redeemed for a physical Hot Wheel.

The Garage opens November 16th. Here’s Motor Trend with more.

ICYMI: We wrote about Non-Fungible Tokens and the Adoption S-Curve on Thursday.

Here’s the money quote from early NFT investor Justin Paterno,

There’s nothing crypto people and your in-laws love saying more than ‘we’re early’ — but with NFTs it’s actually true. We are just scratching the surface with the most obvious use cases in art and collectibles, but I envision a future where nearly every piece of digital content you consume or engage with is tied to an NFT.

Something’s afoot. Next week is “NFT week” in New York City. We’ll report back with our findings…

?? El Salvador Doubled Down — Again.

El Salvador doubled down on Bitcoin, again.

The Central American nation announced it purchased an additional 420 Bitcoin on Wednesday.

El Salvadoran President, Nayib Bukele tweeted the trade —

The country now holds a reserve of 1,120 BTC.

? Worry In Washington…?

US regulators are looking at how banks and their customers could hold crypto assets.

Jelena McWilliams, Chairwoman of the FDIC quipped,

I think that we need to allow banks in this space, while appropriately managing and mitigating risk. If we don’t bring this activity inside the banks, it is going to develop outside of the banks… The federal regulators won’t be able to regulate it.

Here’s Reuters with the full run down.

? Flying Into The Future

Have a look at Jetson One, a personal electric aircraft.

This is the future we love to see. Catch the full clip here.

Who knows… personal flying vehicles could open up the world even more. Living on a cliff may soon be a reality.

Who wouldn’t want to wake to this view —

? Stories You Might Have Missed

Crypto startup Yellow Card is poised for a pan-African expansion

Vote On The Future Of Polkadot’s Brand

Bitcoin Is Mathematical Purity, Says Apple co-founder Steve Wozniak

Dubai regulator announces new regulations for investment tokens

Sequoia Capital just blew up the VC fund model

Tom Brady Gives Fan One Bitcoin In Exchange For 600th Touchdown Ball

Crypto Exchange FTX Buys Super Bowl Ad, Deepening Sports Push

GameStop memes even harder with “Web3 Gaming” and NFT job listings

Helium Taps Dish Network for Crypto-Powered 5G Rollout

Coin Metrics’ State of the Network: Issue 126 – Coin Metrics’ State of the Network

Mastercard and Bakkt Partner to Offer Innovative Crypto and Loyalty Solutions

Korea Teacher’s Credit Union is planning to invest in bitcoin

Crypto VC firm Sino Global Capital launches $200 million fund with backing from FTX

Larry Cermak – VP Research, The Block Ep #50

Robinhood’s crypto COO on retail ‘ebbs and flows,’ NFTs, and new coin listings

Solana-based yield aggregator Tulip Protocol raises $5 million in token sale

this rough-hewn inclined cabin is suspended on a cliff in the italian dolomites

kois associated architects studio visit + interview: ‘timelessness is the only important thing’

Now You Can Climb Outside a Skyscraper to the Top of New York City

International Astronauts Are Simulating Martian Life in a Remote Desert in Israel

iPod: 20 Years Later – On my Om

FOR SALE: Vermont Ski Resort $7.5 Million “No Better Time To Own A Private Ski Resort”

Jeff Bezos’ Blue Origin announces plans for space station Orbital Reef

Would You Pay $550 Million to Live in an Italian Villa (that Includes a Caravaggio Mural)?

New Jersey hits five crypto scams with cease and desist orders