The Proof is in the Protocol

Will Zero-Knowledge Proofs Drive Crypto’s Next Wave of Adoption?

Zero-Knowledge Proofs, or ZKPs, were originally proposed by MIT researchers Shafi Goldwasser, Charles Rackoff, and Silvio Micali (founder of Algorand) in the 1980s but are still in the early days of their integration within the crypto space. Many believe the technology will significantly increase the rate of crypto adoption and be one of the breakthrough technologies in coming years. According to ethereum.org, a ZKP “is a method by which one party (the prover) can prove to another party (the verifier) that something is true, without revealing any information apart from the fact that this specific statement is true”. Currently most blockchains are public, allowing for anyone to view the entirety of transactions and balances on the blockchain. While this could be a positive in many circumstances, such as exchanges sharing their wallets for the public to constantly audit, individuals should have the option for more privacy. Most people wouldn’t want their bank account balances and transactions to be broadcasted publicly and ZKPs are looking to bring a similar level of privacy to crypto.

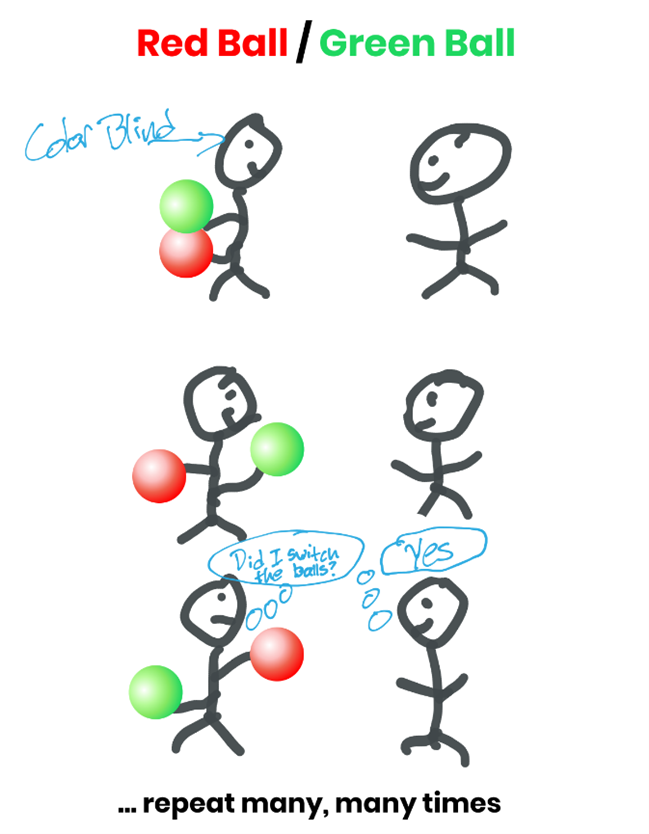

But how do ZKPs work? Here’s an analogy from Zero Knowledge by Packy McCormick and Jill Carlson:

“My color blind friend and I are looking at balls on a table that are identical except that one is red and the other green. He is not sure that he believes me when I tell him they are two different colors. We decide to establish that they are, in fact, different colors by playing a game:

- I give him the two balls to hide behind his back.

- He takes one ball out and shows it to me.

- Then he puts this ball back behind his back, withdraws his hand again, shows me a ball and asks, ‘Did I switch the balls?’

If we repeat this game enough times, and if I answer correctly every time, then I will demonstrate to him that the balls are almost certainly two different colors. Importantly, here, I have proven this to him without revealing any other information. Perhaps frustratingly for him, he still doesn’t know which ball is red and which ball is green.”

While there is far more rigorous math involved in zero-knowledge cryptography, the example above illustrates the basic principles. We are excited to keep an eye on the progression of ZKP technology and see what value unlocks it produces within crypto in coming years.

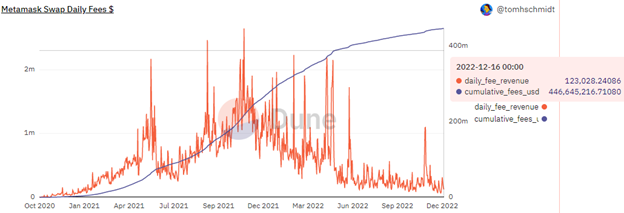

PayPal is Integrating with MetaMask

Payments giant PayPal is getting further involved in crypto. This week the company behind Venmo announced that they’d be partnering with ConsenSys’s non-custodial crypto wallet, MetaMask. The wallet already services over 30 million users worldwide, allowing them to interact with blockchain-based applications and swap Ethereum tokens without giving up private keys to a centralized player. MetaMask utilizes DEX aggregators to get users the best prices and lowest network fees possible when swapping tokens. At the time of writing nearly $24 billion in cumulative volume has been swapped through MetaMask resulting in ~$450 million in revenue.

The PayPal<–>MetaMask partnership will allow customers to purchase crypto directly in their MetaMask wallet using their Paypal account. When the integration goes live MetaMask users will only be able to purchase ETH with PayPal, but more tokens are being looked at to be added in the future. According to PayPal’s latest earnings report they have ~432 million active accounts worldwide.

Apple Backtracking on its Gas Fees Cut?

A few weeks ago, we discussed Coinbase’s Wallet app shutting down NFT transfers citing that it would not be possible to give Apple the 30% cut on gas fees they were demanding. This limitation has been felt by other apps including the iOS versions of NFT marketplaces Magic Eden and OpenSea, which only allow application users to browse NFTs to avoid the App Store’s 30% fee. Recent legislation in the European Union known as the Digital Markets Act will likely force Apple to allow for alternative app stores and payment paths for in-app purchases. The new app stores would allow for apps to be downloaded on iOS phones and tablets without having to adhere to Apple’s stringent policies. This would allow for crypto payments and NFT transactions to flourish on mobile devices. The Digital Markets Act will require tech companies to fully comply with the new set of restrictions by 2024.

While these new laws will only be enforced in the European Union, there have been recent strides by United States law makers that would have similar effects, “The Open App Markets Act, a bill co-sponsored by Sens. Richard Blumenthal, D-Conn., and Marsha Blackburn, R-Tenn., would require competing payment options to be allowed, while the American Innovation and Choice Online Act, a bill co-sponsored by Sens. Amy Klobuchar, D-Minn., Chuck Grassley, R-Iowa, and Lindsey Graham, R-S.C., is designed to protect the ability to sideload apps and prevent operators of app marketplaces like Apple from ‘self-preferencing’ their own products” (MarketWatch). Apple has not commented on how they are going to handle the upcoming regulations yet, but there is significant pressure on them to make changes that should benefit crypto in the long run.

Podcast of the Week:

This week we’re listening to @RyanSAdams and @TrustlessState rehash crypto's biggest events and players of 2022 on @BanklessHQ.

The episode ranks the year's best/worst moments and biggest heroes/villains.

— Osprey Funds (@OspreyFunds) December 16, 2022

ICYMI:

Canada Cracking Down on Crypto Leverage Trading

New Bitcoin and Ether Futures ETFs Debut in Hong Kong

Coinbase Will Now Help Recover Unsupported ERC-20 Tokens Sent by Mistake

Before We Go:

"Buy Bitcoin" has reached a new yearly high on @GoogleTrends$BTC $OBTC pic.twitter.com/y4k5nbzR6p

— Osprey Funds (@OspreyFunds) December 16, 2022