Speed Bumps Along the Bitcoin Adoption Curve

Lydian Kingdom, c. 625-546 B.C.

Imagine how long it must have taken for gold to become universally accepted as a currency or store of value.

Going back a few thousand years, there were no global real-time trade or communications technologies to foster transactions or information sharing.

There were no proxies like futures contracts or exchange traded products.

Not to mention all of the craftsmen, merchants, and politicians who would need to gain exposure to and interact with others who had adopted the metal.

It must have taken a long time.

Today, we are witnessing the global adoption of Bitcoin and it is occurring much faster than the global adoption of gold, although there are still impediments.

A little background…

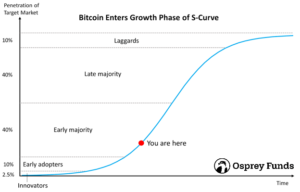

Bitcoin and the Adoption S-Curve

Back in January, we published a piece focusing on the path of Bitcoin adoption.

The adoption of new technologies travels an S-curve that steepens as mass adoption occurs. Here’s the image from that post depicting how we view the Bitcoin curve:

We wrote:

Today, if you believe Bitcoin will serve as “digital gold,” you are in the minority. This is good news for investors.

Why? Well, once everybody has adopted Bitcoin as a store of value, the potential outsized gains from investing will diminish.

What will we be left with then? Gold-like returns.

And how will we know we are there? Gold-like volatility.

As we move through the Early Majority Phase into the Late Majority Phase, Bitcoin demand growth will continue to accelerate.

Human Cognitive Limitations

While global adoption of Bitcoin is progressing much faster than gold must have 2500 years ago, there are still factors slowing it down.

One area that plays a greater role than we recognize concerns the shortcomings of our own thinking. We have cognitive limitations, which inhibit our ability to make choices, including the adoption of new technologies.

Here are three examples of the way cognitive processing limitations might hamper adoption:

Cognitive Conservatism

When presented with new information, people tend to have difficulty revising their beliefs sufficiently.

This cognitive conservatism can be viewed as an extension of the anchoring bias and helps to explain phenomena like underreaction to new information in markets.

When new information is perceived as novel, counter to one’s previously held beliefs, or difficult to understand, our slowness to revise beliefs becomes even more pronounced.

Cognitive Rigidity

People differ in their abilities to shift thinking even as new information arises. We can think of this on a continuum from flexible to rigid.

People who are too rigid might be less open to new ideas, ways of doing things, and technologies. They’re stuck in their ways.

Ego

Sometimes, people dig in their heels and personalize beliefs even as new information arises. This might be a function of maintaining a sense of integrity or self-worth.

Ego might affect how we think and the hills we choose to die on.

***

Human cognitive limitations might slow the adoption of anything new, from ideas to technologies, though it can be difficult to parse them from rational skepticism.

—

Interested in learning more about Bitcoin or the Osprey Bitcoin Trust? We are hosting a live event on June 9th @ 2pm ET. You can register by completing the form below