OpenSea Overtaken in a Blur

Has OpenSea Been Dethroned?

For the majority of the past two years OpenSea has had a stranglehold on volumes amongst NFT marketplaces. According to DappRadar, the OpenSea platform has seen nearly $35 billion in NFT sales volume since its creation in 2017 and the marketplace was valued at $13.3 billion in January ’22. On October 19, 2022, a new competitor, by the name of Blur, entered the NFT marketplace race. Since then, Blur has seen rapid growth in market share, first overtaking OpenSea in weekly trading volume in December ’22 and then blowing it out of the water in recent weeks:

🎶 Blurred Lines 🎶$BLUR has overtaken OpenSea by a significant margin in weekly trading volume pic.twitter.com/FQhH3VgMFm

— Osprey Funds (@OspreyFunds) February 28, 2023

- OpenSea doesn’t have a fungible token associated with its platform, but Blur has been airdropping portions of its governance token, $BLUR, to active users on the marketplace. On February 14th, Blur airdropped approximately 12% of the total $BLUR supply (360M tokens) to over 115,000 users and the average airdrop was worth $2,943. The tokens were given to users that referred others to the platform, listed NFTs on the platform, and placed bids for NFTs that were already listed. The swift user growth has shown these airdrop dynamics to be effective and has allowed Blur to offer the most competitive bid-ask spreads in the NFT space. On February 21st, Blur announced another $BLUR airdrop, expected to happen in April 2023, that is focused on user loyalty:

300M+ BLUR will be distributed to the community in Season 2.

What’s the secret to maximizing rewards? Loyalty.

Users with 100% loyalty have the highest chances of Mythical Care Packages, which are worth 100x Uncommon Care Packages.

Here are 3 ways to maximize your loyalty👇 pic.twitter.com/Cgiemrvpxh

— Blur (@blur_io) February 21, 2023

Essentially, Blur wants users to list all their NFTs through the Blur platform stating, “you get a 100% loyalty score if you don’t have listings anywhere else”. The higher the loyalty score NFT traders maintain, the better chance they have to earn larger portions of the next $BLUR airdrop.

- Blur is an “NFT Aggregator”, meaning it scans other NFT marketplaces allowing traders to see NFTs from multiple sources in one place. Traders can use the aggregator’s capabilities to perform actions like sweeping a collections floor across multiple NFT marketplaces. OpenSea does own an NFT aggregator, called Gem, which Blur has completely left in the dust thus far, capturing nearly 95% of the market share between the two.

- Blur launched with zero-fee trading and makes creator royalties optional, as opposed to the 2.5% cut on trades and enforced royalties that OpenSea charges. Due to the shift in market dynamics, OpenSea has since removed trading fees and stopped enforcing creator royalties.

Crypto Clients Flee Struggling Silvergate

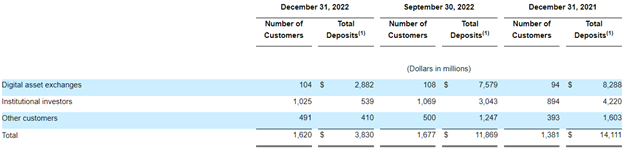

Silvergate Bank is a California-based bank best known for servicing crypto clients. The bank was the first to offer a service, The Silvergate Exchange Network (SEN), that allowed crypto clients to move fiat currencies between their Silvergate accounts and the accounts of other Silvergate clients at all hours of the day, every day. Since crypto markets never close, the ability to have this kind of flexibility attracted many of the largest exchanges and institutions in the crypto industry. At the end of Q3 ’22, Silvergate had 1,677 customers using SEN and about $12 billion of deposits from digital asset customers. During Q4 ’22, approximately 90% of Silvergate’s deposit base was from crypto companies, one of them being FTX. Silvergate immediately lost all FTX deposits when the exchange collapsed and the fear in the market caused many other clients to pull their funds. According to Silvergate’s Q4 ’22 results, the nearly $12 billion in deposits from crypto clients at the end of Q3 ’22 dropped to approximately $3.8 billion by the end of Q4 ’22:

Despite the struggles, Silvergate saw signs of life during Q1 ’23 when some of the world’s largest financial institutions revealed large holdings in the company; including State Street (9.32%), Susquehanna Securities (7.5%), BlackRock (7.2%), and Citadel Securities (5.5%). But this week, on Wednesday, the bottom fell out for Silvergate stock ($SI) when the company announced that it could not file its annual report with the SEC on time, stating a need to reevaluate its business strategy and ability to continue operating. This warning was enough to incite a mass exodus from the bank. “Coinbase and Galaxy Digital dropped Silvergate as their banking partner” and “Paxos, Circle, Cboe’s digital asset exchange, Bitstamp, and Gemini suspended their partnership” with the bank. On Friday, Silvergate announced on their website that “Effective immediately Silvergate Bank has made a risk-based decision to discontinue the Silvergate Exchange Network (SEN)”. Shares of Silvergate closed at $5.77 on Friday, down ~61% from last week’s high of $14.68 and down ~97.5% from the all-time high of $227 in November ’21.

ICYMI:

Algorand Hires its First Ever CFO

Coinbase Acquires One River Digital Asset Management

Base Integrates Chainlink for Secure Off-chain Price Feeds

Gillibrand, Lumis Plan Revamped Crypto Bill for April

Before We Go:

The #bitcoin Layer-2 protocol @Stacks’s native token, $STX, is up approximately 350% YTD as the hype for Bitcoin JPEGs, Ordinals, accelerates.

This is likely due to speculation that Stacks will simplify the minting process and host marketplaces for Ordinals: pic.twitter.com/mJlmwpo6DM

— Osprey Funds (@OspreyFunds) March 1, 2023