Bitcoin Volatility, Fear, & Greed

Galveston Island Historic Pleasure Pier, Galveston, Texas, Photo by Matthew T Rader.

The stock market is the only market where things go on sale and all the customers run out of the store.

Besides love, nothing drives people crazier than fear and greed.

In markets, these emotions sometimes drive excessive volatility. When prices rise, we take more risk than we otherwise would. The faster the rise, the more we throw caution to the wind.

When prices fall, we reduce risk more than we otherwise would. The bigger the fall, the quicker we run out of the store.

This is all just human nature of course. We hate missing out and we hate losing even more.

Just as fear and greed affect how we behave in markets, they affect prices too. You get lots of investors fleeing losers all at once or chasing winners together and prices fall or rise respectively.

The more intense the collective emotions, the bigger and faster the moves.

This is a circular dance. Emotions affect prices which in turn affect emotions in a positive feedback loop that serves as the source engine of price volatility.

Which brings us to bitcoin…

Bitcoin and Volatility

Bitcoin moves fast in both directions.

The price fell more than 80% from the December 2017 high to the December 2018 low. Then, it rallied 800% from the March 2020 low to the January 2021 high. And that’s just the past 3 years.

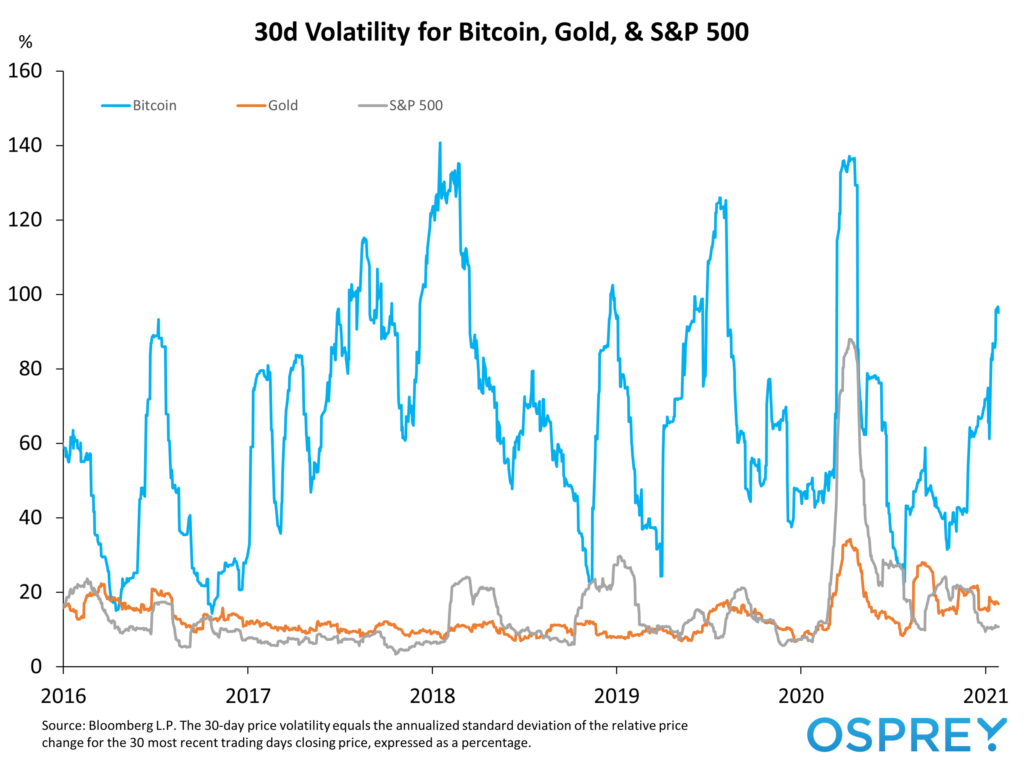

Bitcoin is 5x more volatile than gold and 9x more volatile than the S&P 500. Have a look at a five year chart of the 30 day volatility comparing the three:

Along with the price volatility, it’s been an emotional rollercoaster.

HODLing, Fear, and Rational Investing

Modeling a rational long-term investment approach is not the hard part about wealth management. The hard part is following through on that plan with discipline over years without getting derailed during periods when the market falls sharply as it did in the Spring of 2020.

This is when fear grips us and we are most tempted to run for the exits. Nevermind that we have a plan. Nevermind that markets tend to bounce back and rise over longer periods.

HODLing is a slang term bitcoin investors use to describe long-term holders who’ve managed to ride the volatility rollercoaster without selling in fear.

People make fun of the term. It has a funny name and a quirky origin.

The history of digital assets is much shorter than stocks. Bitcoin is 12 years old while the history of the S&P goes back to the 19th century.

So we have less data to extrapolate historical trends.

Nevertheless, hodling seems like a rational strategy to express a bullish fundamental thesis akin to long-term stock investors who stick to their plans, managing not just their wealth, not just their risk, but their fear.

Phil Pearlman is the Chief Behavioral Officer at Osprey Funds.

This information should not be relied upon as investment advice, or a recommendation regarding any products, strategies, or any investment in particular. This information is strictly for illustrative, educational, or informational purposes and is subject to change. The author of this article owns bitcoin, directly and through the Osprey Bitcoin Trust.