Last Updated: 04/27/2022

Predictions by Osprey Funds were made as of April 2022.

We see incredible potential in AVAX.

Key Takeaways

- Avalanche could outperform Solana in capturing share in GameFi. Gaming is the gateway to true decentralization.

- A new $290M (4M AVAX) incentive program was recently kicked off to build out projects and attract new developers.

- $10.38Bn total value locked (TVL) also ranks in top 4 in DeFi.

- The Avalanche team is partnering with Wildlife Studios, one of the 10 largest mobile game developers in the world, to launch their own subnet on Avalanche.

- Developer base and users will grow due to subnets.

- Inflation rate to be 31.4% in year 1 and 23.88% in year 2 solely as a result of network staking and projecting circulating supply increases.

After spending months studying the Avalanche blockchain and its coin, AVAX, we are proud to share our research publicly so you can better understand this layer 1 and its potential as a worthy investment.

Our Model Assumptions

To reach our forward estimate of circulating supply, we assume that only newly minted tokens serve as validator rewards. Staking rewards are not generated via fees since 100% of network fees are burned. We estimate the inflation rate to be 31.4% in year 1 and 23.88% in year 2 solely as a result of network staking and projecting circulating supply increases.

We also consider an initial reward to project founders, creators, and other close parties ‚Äď the genesis reward of 320M AVAX ‚Äď to vest at 14% year over year (YoY) and include this in the circulating supply over time according to the vesting schedule.

Given the nascent trading histories of Layer 1 blockchains, we feel that it was conservative to only focus on the drivers of transaction value growth and token supply to derive our price targets without adjusting the NVT multiple even though we recognize, particularly in the case of AVAX, that its NVT is relatively cheap compared to our growth assumptions.

Avalanche provides a functional backbone while hosting a rich, developing ecosystem, a scalable model to onboard millions of users in the future with advanced primitives to enable any decentralized application (dApp) to transact swiftly with an expanding ecosystem of applications from gaming, decentralized finance (DeFi), non-fungible tokens (NFTs), institutional onramps, and payment infrastructure.

Avalanche has elevated the layer 1 competition for fast on-chain settlement to sub 1 second, aka ‚Äėtime to finality‚Äô. It shows in the numbers.

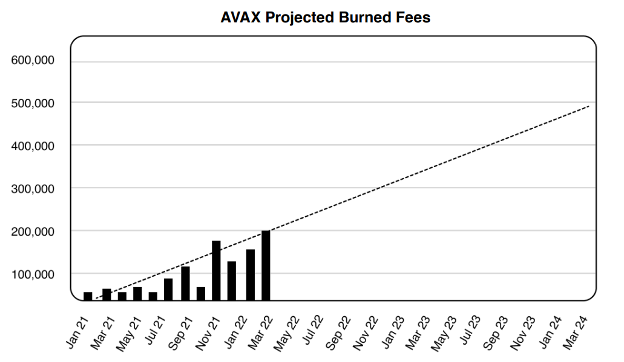

All cases (Base, Bull, Bear) consider that 100% of fees are burned for every transaction and for other types of network activity such as launches of new blockchains within the ecosystem (see subnet discussion below). 100% burn of transaction fees is specific to Avalanche and works to balance the network’s circulating supply since the network is net inflationary, which we’ve projected to be 31.4% next year [2023] and 23.9% the following year [2024].

We’ve also factored in the genesis release and vesting periods for the initial release of 320M AVAX to original network participants, including founders, investors, public sales and foundations specific to the support of the Avalanche ecosystem over the long term.

Staking rewards were projected over time and factored in as they are the only source of new token supply for the protocol. This is also a trait unique to the network from a supply perspective considering all fees are burned and not distributed to validators like in other networks, such as Ethereum.

Avalanche is Competing Against Solana for GameFi

We view Solana and Avalanche as layer 1 competitors in the GameFi space, as Avalanche grows with the market with a fast, cheap and customizable network at its base. The GameFi pie is large and growing.

Estimates project the total addressable market for gaming at $335Bn over the next five years.

In our base scenario, we believe Avalanche can capture similar value to its layer 1 competitor, Solana, over the next three years.

The Avalanche team is partnering with Wildlife Studios, one of the 10 largest mobile game developers in the world, to launch their own subnet on Avalanche. Castle Crush will be the first Wildlife game to integrate Avalanche-based NFTs and tokens in June [2022] that can be earned, minted, traded, etc. The game already has 1M monthly players and is part of the $290M Avalanche Multiverse effort in addition to many other games.

Avalanche Looks Good for Quick, Creative dApps

Ease of development and deployment for builders of new projects on Avalanche is competitive amongst other layer 1s. Avalanche uses an instance of Ethereum’s virtual machine (EVM) to run DeFi chain activity. It provides the best of both worlds, as developers can jump in and create new dApps with the Ethereum-compatible smart contract language, Solidity, while taking advantage of AVAX’s specific primitives which speed transaction throughput and bifurcate the chain into scalable parts.

Deployment of subnets and new ecosystems is a process that takes under ten minutes so developers can spend more time on the functionality of the application they’re building.

The Genesis

On September 21st [2021] Avalanche’s official mainnet was launched. The network released 360m tokens at launch, however slightly over 1/3 of the supply will continue to vest over time until the latter half of 2030.

There are currently only 266m tokens in circulation with an ultimate capped supply of 720m and the remainder to be released mostly over the next two decades. The genesis release of the 360M AVAX network supply went to the Avalanche Foundation, team members, community, development uses, and public / private sales.

The founders and team members building the chain have voluntarily locked their assets for four years after mainnet launch which aligns the protocol growth to the original developers over a longer time horizon. The Avalanche Foundation earmarked supply from the genesis release vests over 10 years which also aligns incentives in the long term to boost community initiatives.

Avalanche Uses Subnets, a First for Layer 1s

What is a subnet: Subnets are a group of validators that focus on consensus for a particular sub-chain in the overall Avalanche network. They are primitives in the Avalanche ecosystem that allow for the creation of sub-blockchains.

Subnets are an entirely new primitive specific to the Avalanche ecosystem. Subnets are application-specific chains that ringfence traffic. As projects grow, they can be offloaded from the main protocol to a dedicated subnet to ringfence traffic from the wider network, lowering fees and transaction times. They create a scale-by-unit model by localizing traffic to keep congestion on the mainnet to a minimum for smaller use cases. Larger projects can completely customize their chain with its own validator network, virtual machine, tokens, monetary system, privacy, and other settings.

Ethereum layer 2 functionality is not inherently built into the base-layer protocol for ease of creation once layer 2 limits are reached. Ethereum layer 2 chains will eventually become congested if the Ethereum ecosystem continues to grow since the same layer 1 congestion limits apply. Avalanche plans for this type of organic growth by allowing subnets with different groups of validators to focus on processing activity for individual chains.

One popular application on the network currently is a play-to-earn and completely decentralized game called Crabada, a treasure-lootin’ experience where gamers play as a crab and try to avoid laser attacks and rockets fired their way.

Save your crabcakes because you can count on gameplay to be as realistic as it gets on the ocean floor. Crabada has recently moved to its own subnet and off the main chain, which directly lowers network fees for all. This is a good example of an application currently consuming 16% of network gas to move to its own subnet and offload the burden from the mainnet. It’s a great example of subnet usage in action simultaneously benefitting the wider network and the individual dApp.

While subnets are not for every project, they will provide a large benefit initially to larger projects to retain network speed while not affecting the wider Avalanche network. It is all about keeping the transactional flow moving, little to no friction, low fees, and the network stable. Subnets should disappear into the background while providing these simple but critical benefits that will allow large projects to scale their user bases quickly and exponentially.

Avalanche Uses 3 Chains to Increase Speed

Avalanche network is divided into three separate chains (X-Chain, P-Chain, C-Chain) that are interconnected and each serve a specific purpose by splitting the types of transactions they process.

Each chain is specialized to perform specific purposes and is built with the function in mind. This makes each specialization faster than a one-size-fits-all processing model seen on other chains like Ethereum, an important differentiator.

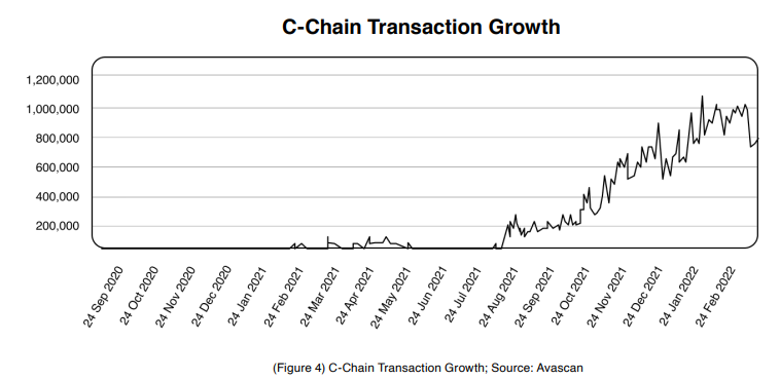

The C-Chain, which is by far the largest chain in the ecosystem by transactional activity, provides the ability to generate smart contracts by running an instance of Ethereum Virtual Machine (EVM). Unique addresses on C-Chain have grown just slightly… at 80x YoY.

C-Chain transaction counts have increased about 77x since August 2021 and have been on a consistent uptrend. This chain is the DeFi-specific world in the Avalanche ecosystem ‚Äď you can also interact with it via DeFi wallets that support Ethereum. The C-Chain is also a wider example of how competing layer 1s to Ethereum are integrating EVM compatibility to migrate other DeFi users to their own chain.

Should We All Invest in AVAX?

There is a lot of potential for Avalanche as it expands further into gaming and dAPP development. As more users and developers continue to adopt this crypto and share their creativity, we see Avalanche as being one of the more fruitful and aggressive cryptocurrencies currently on the market [as of April 2022].

For more information, download our complete paper that includes more predictions and further information on the risks and rewards of buying into AVAX. Contact us if you have any questions.

Get the Full Avalanche Analysis Here

The aforementioned information is based on a study conducted by Osprey Funds’ Research Analysts. Any numbers regarding future events are outcome predictions, not factual data. We are not recommending that you invest in Avalanche (AVAX) based on the information contained here. Please use this data and information as assumption only.