Last Updated: 04/27/2022

Predictions by Osprey Funds were made as of April 2022.

The Ethereum blockchain has most notably been used to carve the path in non-fungible tokens (NFTs) and how we view blockchain interaction. It is a current pillar to layer 1s (L1s) and is the go-to for many users who are just starting out in the crypto space (aside from Bitcoin). But can it withstand the tides of new blockchains that are focused on efficiency and environmental impacts?

Key Takeaways

- Current transaction growth trajectories of 61% YoY are maintained in the base case, while they 2x in the bull case and 1/2 in the bear case.

- Makes up almost 1/5th of the crypto market by circulating market capitalization and is second to only Bitcoin.

- 90-day active addresses and new funded addresses on the network have grown by 50% YoY since 2020.

- Number of addresses with a non-zero balance have grown 6x since 2020.

- Ethereum will release Sharding, a way to speed up transactions across the network. There is an expected 64 chains that will be created.

- Ethereum is looking to become the #1 web3.0 protocol.

- Ethereum will implement EWASM to lower barriers of entry for new developers.

DEEP DIVE: An Initiation on Ethereum (ETH)

Ethereum is the behemoth of layer 1 protocols. Thereâs no denying its influence, domination, and longevity as the most widely used smart contract network in crypto and web3, and by a wide margin. Here are some stats:

- Currently makes up almost 1/5th of the crypto market by circulating market capitalization and is second to only Bitcoin.

- 90-day active addresses and new funded addresses on the network have grown by 50% YoY since 2020.

- Perhaps most notably, the number of addresses with a non-zero balance have grown 6x since 2020.

Some could argue it has already won the protocol war and achieved the adoption it needs to continue its dominance into the future. While there are still other layer 1s competing for a shiny #1 web3 trophy, ETH is still the heavyweight champion. It will be hard to unseat while challengers make attempted inroads at additional market share.

Maybe youâve been hearing a lot about Ethereumâs planned roadmap over the years, implementation schedules, delays etc. We have laid the latest out below so you can see for yourself â it is closer now than it ever has been and has the potential to enter another era by Q3 2022.

Ethereum Serenity Upgrade

- Phase 0 – Beacon Chain Staking: This is the proof-of-stake blockchain that currently went live in 2020 and is operating separately from the Ethereum network. Validators are currently staking ETH to participate in the chain. You must have at least 32 ETH to stake, but it will be locked up until after the network merges with the proof-of-work chain when functionality is implemented to withdraw staked ETH. No date has been confirmed as to when participants can unstake.

- Phase 1: Proof-of-stake implementation where the Beacon chain is merged with Ethereum mainnet, the current proof-of-work chain by Q3 2022.

- Phase 2: Sharding will be implemented sometime in 2023, which will split the network into 64 chains and enable network activity to be processed in parallel. Doing so will potentially enable the network to reach 100k TPS (transactions per second). More on sharding later.

Technical Features/Network Design

Feel the Burn â EIP 1559

EIP 1559 is an Ethereum upgrade that was launched on August 4, 2021 which was developed to improve on the Ethereum fee system while transacting on the network. Prior to the upgrade, transaction fees were unpredictable, volatile and in many cases, users would end up overpaying by multiples over what they could have paid.

1559 creates a predictable relationship between network congestion and the base network fee adjusting as needed â a process automatically set by usersâ wallets â and saves on transaction costs. Users can adjust a tip amount to send to miners and in the future, to validators, to push their transaction ahead in the queue depending on how quickly they want it to be processed. Miners/validators get to keep the tips that the user sets, but the base fees are mostly burned by the network.

You can already see the EIP 1559 network upgrade in action. In the first three years / early days of ETH, inflation was the highest and averaged 11.3%. While it ultimately settled down to an average yearly rate of 4.36% in the two years leading up to EIP 1559, it was still cut by 72% on average after the burn mechanism was implemented in August 2021.

On 14% of the days since activation, negative net inflation has occurred. For instance on January 10, 2022 Ethereum was 1.8% deflationary. We determined network inflation by annualizing daily ETH issuance and subtracting burnt fees.

Prior to the upgrade, the networkâs monetary policy only incorporated issuance determined by diminishing block rewards over time set in network code. While there were other notable block reward decrease upgrades to the network in the past, like the Byzatium fork in 2017 and the Constantinople fork in 2019, there was never an upgrade that included a burn component which actively reduced circulating supply

Our ETH Prediction Model Assumptions

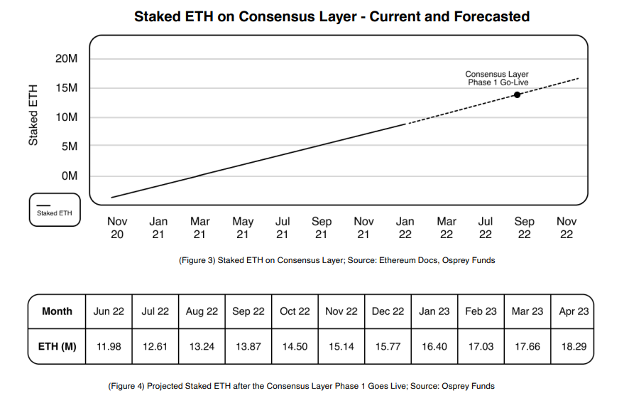

We assume a Q3 2022 go-live for ETHâs consensus layer. In our network issuance/staking calculations, we also assume 98% of validators are online and project that staked ETH continues on the same, linear upward trajectory until the merge occurs in Q3 2022.

In all our cases, we consider inflation in a proof-of-work (PoW) regime which includes a moderate net inflation rate of 1.25%, an issuance rate of 4.18% and a burn rate of 2.93% due to EIP-1559.

After the merge, we assume net inflation to be -2.28%. Current transaction growth trajectories of 61% YoY are maintained in the base case, while they 2x in the bull case and 1/2 in the bear case. We also assume an ETH consensus layer Phase 1 go-live in Q3 2022 and adjust network issuance based on predicted staked ETH at that time in line with network economics.

Ethereum Plans to Speed Up Transactions with âShardingâ

Sharding adds to Ethereumâs ability to scale and will lead to more participation and the ability to spread processing over a wider network. The concept sub-divides the network to process network activity in smaller chunks in parallel instead of in a linear fashion.

This dramatically speeds up transaction processing times by many multiples and significantly lowers the barrier for validators to join the network.

Version 1 of sharding implementation also decreases the data that validators will need to store, only requiring validators to store data specific to their shard and not the entire network. This is where real speed benefits are realized.

Ethereumâs goal is to create a total of 64 unique chains within the network.

Sharding will be released in a series of different versions, but there is still debate on the subject on whether code will be executed on the shard chains. TBD on this but the ultimate difference is that even at version 1, 64 shard chains will provide at least a ~6600x greater transaction throughput (10 to 15 TPS â 100K TPS).

What really matters is the ability for individuals anywhere with a laptop or mobile device to eventually participate by running clients for sharding. This is a powerful concept, and if properly executed, will make Ethereum even more secure, decentralized and significantly faster with lower barriers to entry.

Ethereumâs Future is Looking to Layer 2s

Sharding will work in conjunction with scaling solutions like ZK (Zero-Knowledge) and Optimistic Rollups. While sharding exists at the layer 1 level, layer 2 solutions also seek to expand network capacity by providing additional speedways via added chains.

Layer 2s are simply chains where value is transacted separate from the layer 1 execution layer but settled on the main chain once transactions are netted.

This decreases the processing load on the execution level by cutting down the number of transactions while higher level 2 chains are freed to transact network activity. It is a specialization of work split between separate but interconnected chains.

When sharding is combined on the main chain with layer 2 solutions, the network becomes even faster and more usable to support hyper growth of users and transactions on the network, especially if Ethereum becomes the go-to web3 protocol.

Deflation Forecast

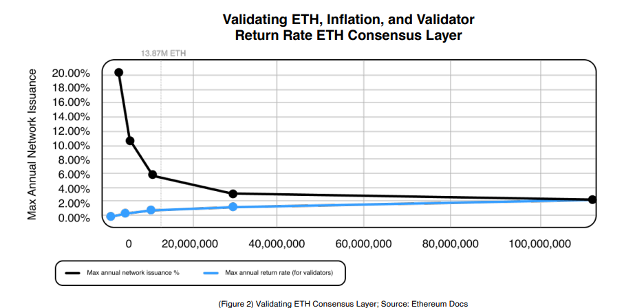

Staked ETH is the driver of network issuance tokenomics in the new consensus layer. See Figure 2 below which shows the relationship between staked ETH, network issuance and validator return rate at each level of staked ETH.

Weâve also projected staked ETH amounts based on the current trajectory and determined the value should be around 13.87M staked ETH by that time. According to the staked ETH to network issuance relationship, this puts the future ETH proof-of-stake max issuance rate at around .6%.

But wait, doesnât that mean ETH is slightly inflationary?

Nope.

Not when we included the average burn rate, which is dependent on transaction activity on the network. If you consider the average burn rate at current transaction levels, it reveals that ETH proof-of-stake may very well become deflationary by about 2.25%.

We found that the deflationary aspects are indirectly accretive to long term token holders and the network overall â HODLing essentially pays the HODLers. It pushes up price targets a bit in an ETH proof-of-stake world vs. without activation

Weâre Cautiously Optimistic About the Risk and Challenges

While Ethereum still remains the dominant layer 1 by far, it is simultaneously the target of an ever-evolving ecosystem of competitors to no oneâs surprise.

Many layer 1s, and even layer 2s, are employing EVM compatibility to even the playing field and are vying to gain share from Ethereumâs ecosystem by allowing people to interact with the protocol via their own blockchain. A great example of this is Fantom that allows EVM (Ethereum compatible) dApps to be deployed on their network. Fantom asserts that deploying on their network lowers costs vs directly using Ethereum.

Evidence can be seen in on-chain TVL dominance. Ethereum accounted for 97% of TVL across DeFi in mid-January 2021. Its dominance has fallen by 43% since, or 2.7% per month on average, and sits around 54% of all DeFi TVL across chains as participants explore other ecosystems.

The industry could see a world in which Ethereum represents under 25% of DeFi TVL a year from now if the trend continues at the same rate. Of course, total TVL can also increase in the meantime where, although Ethereum could hold a smaller slice, it will be of a larger pie and still claim TVL dominance.

Layer 2 challenges of scaling may also eventually run into the same issues as the layer 1 execution layer. Solutions like Arbitum and Optimism are separate chains, and while transaction speed is fast at the current point in time, they may ultimately run into the same congestion issues in the long run when transaction throughput increases.

Full decentralization after transition to a proof-of-stake network can also be an issue, as large organizations like Coinbase are currently running a large share of validator clients on the Beacon chain prior to go-live.

Weâll see what happens as Ethereum works through its upgrades and features.

Get the Full Ethereum Analysis Here

The aforementioned information is based on a study conducted by Osprey Fundsâ Research Analysts. Any numbers regarding future events are outcome predictions, not factual data. We are not recommending that you invest in Ethereum (ETH) based on the information contained here. Please use this data and information as assumption only.