When people ask us if Bitcoin is digital gold, here’s what we tell them.

First, there are all the reasons you might have heard before that say it is:

- Bitcoin was designed to behave like a digital currency but has evolved to behave like a store of value.

- Like gold, bitcoin is rare, uniform, universally accepted, easily divisible and impervious to decay, rot, or spoiling.

- Both are scarce – there is a finite supply of 21 million Bitcoin.

- Better than gold, Bitcoin is digital, making it easier to transfer.

Yes to all of these and we could go on. But Bitcoin has appreciated much more than gold and we think it will continue to do so and so there must be a difference that explains why.

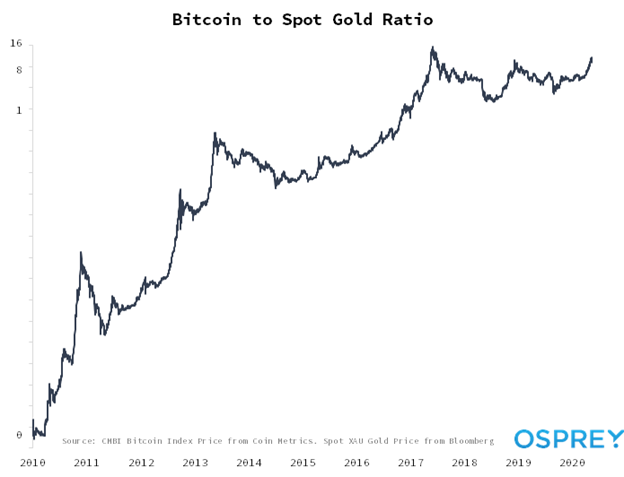

Here is a Bitcoin/gold ratio chart that visualizes the considerable outperformance:

Here’s a key difference between Bitcoin and gold, that helps explain this outperformance and suggests the trajectory going forward.

The two assets are very different in terms of stage of adoption.

You Are Here on the Bitcoin Adoption S-Curve

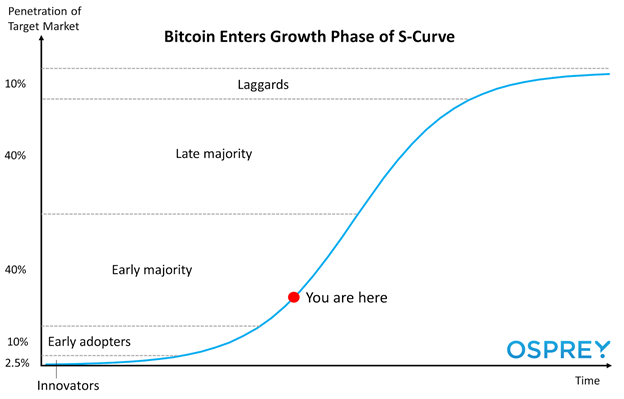

Breakthrough technologies often follow an Adoption S-Curve.

This Adoption S-Curve reflects the cumulative rate at which a population adopts a new technology or product. Here’s what this looks like relative to Bitcoin:

The S-Curve breaks global adoption into stages along the growth cycle: Innovators, Early Adopters, Early Majority, Late Majority, and Laggards.

Most of the growth occurs during the Early and Late Majority stages.

Bitcoin is 12 years young and it is much earlier along this curve than gold which has been a Laggard for millenia.

We believe bitcoin is now in the Early Majority Phase as measured by the number of global investors and the total amount invested so far.

Marginal dollars will be added to bitcoin as adoption continues along this curve and this will be massive.

This Adoption S-Curve phase is the demand force behind Bitcoin’s stellar returns.

More Than Digital Gold

Today, if you believe Bitcoin will serve as “digital gold,” you are in the minority. This is good news for investors.

Why? Well, once everybody has adopted Bitcoin as a store of value, the potential outsized gains from investing will diminish.

What will we be left with then? Gold-like returns.

And how will we know we are there? Gold-like volatility.

As we move through the Early Majority Phase into the Late Majority Phase, Bitcoin demand growth will continue to accelerate.

Greg King is the Founder and CEO of Osprey Funds.

This information should not be relied upon as investment advice, or a recommendation regarding any products, strategies, or any investment in particular. This information is strictly for illustrative, educational, or informational purposes and is subject to change. The author of this article owns bitcoin, directly and through the Osprey Bitcoin Trust.