Bitcoin and the Correlation Illusion

Photo By Scott Webb

People love to find relationships between things so much we sometimes contrive them where they don’t exist.

The fancy term social scientists use to describe this thinking error is illusory correlation, but really we just can’t stop trying to make meaning out of a world we don’t fully understand.

Recently, bitcoin has been coupled with risk-on assets like the Nasdaq 100. People observe very short-term similarities in performance, extrapolate correlation, and then reach larger conclusions like bitcoin is simply another risk-on asset.

They’re trying to make meaning.

Over the years, bitcoin has been compared to a variety of assets when brief price behavior similarities occurred, leading to a string of erroneous conclusions.

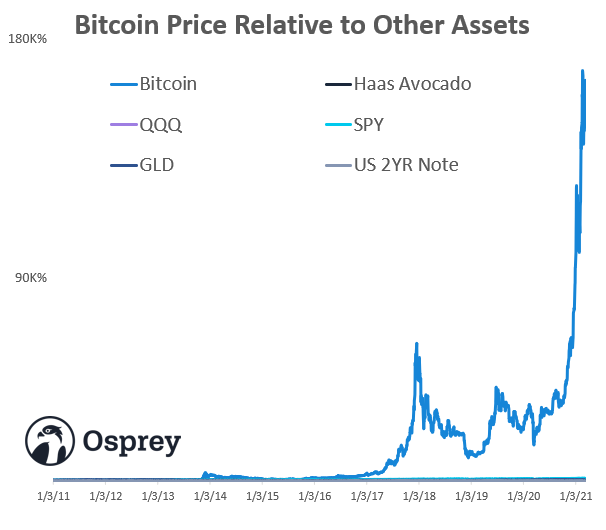

It has been alleged to correlate with risk-on assets, gold, and bonds. Bitcoin has even been paired with Haas avocado prices. Classic!

In reality though, and over longer time frames, bitcoin is doing its own thing. It’s a novel asset and distinct from the things we yearn to liken it to.

Here’s a 10 year chart of the price of bitcoin relative to these other assets.

We asked our pal JC Parets (see more below) about this and he added some further food for thought:

Bitcoin is too small a market to have intermarket implications. With stuff like bonds, gold, and growth stocks, you’ll see those relationships because the same huge players are deeply involved with all of them. But bitcoin is not in that category, at least not yet.

The All Star Charts Podcast with Osprey Founder/CEO Greg King

Speaking of JC, he hosts the All Star Charts Podcast where our founder and CEO Greg King recently appeared.

This is a great listen.

Squawk Box and The S-Curve Revisited

Greg was busy this week stoking the financial media machine. He also appeared on CNBC’s Squawk Box yesterday morning and chopped it up with Ginsu sharp Andrew Ross Sorkin.

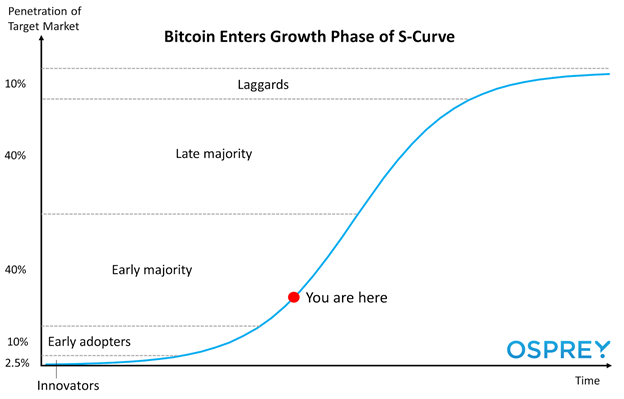

"What we have is an S curve of adoption," says @OspreyFunds CEO @GregKingOsprey on #btc. "This technology is being adopted on a global basis, and the amount of demand potentially for what it is providing is huge. We are looking at this as a long term rally–a year or two." pic.twitter.com/7ng76f8Prk

— Squawk Box (@SquawkCNBC) March 10, 2021

Among other things, they discussed bitcoin adoption and Greg alluded to his piece we published a couple months back describing the bitcoin adoption path. Here’s the money graphic:

Have a great day everyone.

Phil Pearlman is the Chief Behavioral Officer at Osprey Funds.

This information should not be relied upon as investment advice, or a recommendation regarding any products, strategies, or any investment in particular. This information is strictly for illustrative, educational, or informational purposes and is subject to change. The author of this article owns bitcoin, directly and through the Osprey Bitcoin Trust.