Last Updated: 04/27/2022

Predictions by Osprey Funds were made as of April 2022.

Key Takeaways

- Solana offers parallel processing, giving the network a distinct speed advantage of 65k TPS.

- Proof-of-history speeds up processing so validators do not have to individually check and confirm with other nodes.

- Solana has huge potential in GameFi with a rich NFT gaming ecosystem.

- Solana offers CLOBs that enable limit order, bid, and ask functionality like a traditional exchange.

- We believe more developers will ultimately be attracted in the long-term as a large contingent will need a high performance blockchain at scale.

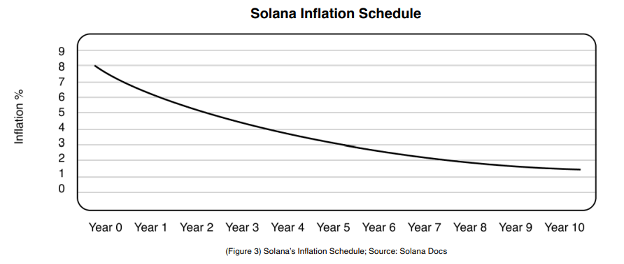

- Solana’s network is inflationary, but that inflation rate decreases at a steady rate for the next 10 years.

- New SPL tokens have doubled since June 2021.

- Active programs Solana have 5x since June 2021.

- SOL reached an all-time high of $258.93 in November 2021.

Our Model Assumptions

We consider that the SOL inflation percentage rate steadily declines by 15% YoY over the next 10 years (disinflation rate) as defined by the network which ultimately targets a 1.5% inflation rate in 15 years after launch. The network burns 50% of all transaction fees. Daily and wrapped SOL transfers were measured over time.

We see future adoption of Solana accelerating based on real advantages over traditional layer 1s focused on defining functionality inherently built into the network. True speed advantages are secured over competitor chains based on modifications to the underlying network structure and function.

We believe more developers will ultimately be attracted in the long-term as a large contingent will need a high performance blockchain at scale – Solana meets these criteria due to a thoughtful network architecture from inception.

DEEP DIVE: An Initiation on Solana (SOL)

Why Wait? Just Separate

65K theoretical transactions per second (TPS) is a good reason not to wait for anything on Solana. Solana programs, otherwise known as ‘smart contracts’ on other protocols, separate program code from data with an implementation called ‘SeaLevel’. This model is different from Ethereum where smart contracts contain both code and data.

On Ethereum, instructions from one smart contract can be run one at a time and transactions are processed in a sequential fashion. Solana can achieve much faster results since data can be simultaneously passed as input to programs. This enables many inputs to be sent at once and multiple copies of the program to run in parallel to increase performance. Multiple programs can also be processed at one time.

Everyone on the Same Page

Proof-of-history (POH) is an idea that revolves around the simple agreement of time – essentially trusting a timestamp when receiving a message. This might sound trivial, but it has been an issue for decentralized networks in particular. By centrally producing a publicly verifiable order of events, nodes do not have to check with other nodes to confirm agreement of time and event ordering.

The main protocol assigns every event and transaction a unique code, or hash, and broadcasts the information. It offloads the burden from each validator on the network to calculate a time stamp and centralizes this functionality within the system. Doing so is one of the main reasons for Solana’s increased speed and transaction throughput compared to other layer 1s as the heavy lifting and processing of time and order happens separately from validators. Network lag is greatly reduced.

Best Baked in Batches

Transactions on Solana are meant to issue instructions to programs on the protocol. Each program is specialized to perform different functions for the network including simple activities like transferring SOL.

While Solana only has one transaction type, it differs from Ethereum where there are specific transaction types which can only be run sequentially. Each transaction on Solana can hold a bundle of instructions to direct programs to perform actions. Calling different programs that enable different types of functionalities in this way allows Solana to split work and simultaneously instruct many programs at one time.

For instance Solana has a main token program on the protocol where minting, transfers, and burning tokens take place. Accounts are created specifically to interact with a program on the network and can “transact” with the program to execute these actions in parallel, making the network faster.

Around 90% of the Solana network is broken down into mostly external calls to pull in data from outside sources to inform decentralized programs, token transfers, DeFi transactions on the Solana-based Serum DEX, and new accounts information on data and ownership. Additional network activity also consists of consensus activity. At current rates, Solana is processing 2.4k transactions per second which is inclusive of much of the above activity.

High Standards

Anchor is a Rust-based development framework for Solana that provides tools to build on the protocol. It makes working with repetitive tasks and nuances of Solana much easier, a defining quality amongst layer 1s, and is meant to attract many developers.

Projects like the popular Serum DeFi platform were built with Anchor. Solana also has a fast runtime platform similar to Ethereum Virtual Machine (EVM) called Low Level Virtual Machine (LLVMs) where programs are run and instructions are executed.

The protocol hosts a vibrant DeFi ecosystem which revolves around the Solana Program Library (SPL) token standard. The protocol has one token standard, SPL, for both fungible and non-fungible (e.g. NFTs) tokens. Wrapped SOL is also on the same SPL standard to facilitate interaction with the rest of the DeFi ecosystem. It can later be unwrapped in a Solana wallet back to the protocol’s native token, SOL.

Inflate and Delegate

Solana’s network is inflationary, but that inflation rate decreases at a steady rate for the next 10 years. The network supply was set to an initial inflation rate of 8% and coded to target a long-term inflation rate of 1.5% in 15 years. Below is a model of the first 10-year predicted inflation curve with a 15% YoY dis-inflation rate over the same period.

The network’s inflation schedule provides an advantage compared to most other layer 1s since it creates conditions for network validators to earn around 6% delegating SOL and more than that if individuals run a validator, especially accounting for any network fees validators accrue.

Solana focuses on “professional validators” to create a high performance and highly secured network. These types of validators run enterprise-grade hardware with extremely fast connections and high uptime/availability.

One of the criticisms of the network, though, is that it may not be as decentralized as other protocols, with fewer number of validators given a preference for higher quality operations and hardware.

Is Solana a Good Investment?

On September 14th [2021] the network was flooded by a deluge of transactions from bots, overloading validators and crashing the network for 17 hours. Uptime is the most valuable statistic for any global network and if Solana aims to be one of the main layer 1 protocols, it must be accessible nearly all of the time (as an example, AWS has 99.9% uptime service level agreements).

There are also 10x as many DApps built on Ethereum. If the protocol wants to establish itself as the Ethereum killer, or at least make significant inroads, it must outpace Ethereum’s ecosystem growth. Additionally the network must attract a similar contingent of developers to produce these dApps.

Also in the recent Wormhole hack, hackers exploited a bug in a protocol that bridges Ethereum to Solana. An attacker was able to mint wrapped ETH on Solana’s network that was not backed by deposits and bridged ~94k ETH to Ethereum, ultimately withdrawing the exploited proceeds. While it wasn’t a direct bug in Solana’s protocol, the Wormhole network was exploited which interacted directly with Solana.

Bridging risk remains significantly high and will continue to, as exploits like the Wormhole hack remain in the collective crypto conscious for the long-term.

Due to the nature of bundling many instructions, transfers, and consensus votes in individual transactions, it becomes harder for network participants to have a view into the real economic statistics of transaction flows and value moving through the network.

While the network is seemingly transparent at first glance with statistics of transaction speeds and counts, network explorers would benefit from separating monetary transaction flows or providing an easy way to pull this data from the blockchain.

Get the Full Solana Analysis Here

The aforementioned information is based on a study conducted by Osprey Funds’ Research Analysts. Any numbers regarding future events are outcome predictions, not factual data. We are not recommending that you invest in Solana (SOL) based on the information contained here. Please use this data and information as knowledge only.