Last Updated: 04/27/2022

Predictions by Osprey Funds were made as of April 2022.

Living its best life – Bitcoin (BTC) has remained resilient in the face of a consistent barrage of attempts to declare it not useful, nonfunctional or dead… instead Bitcoin’s motto is YOLO.

Key Takeaways.

- Growth of daily average transaction values are up 14x, a 1300% increase, since 2019.

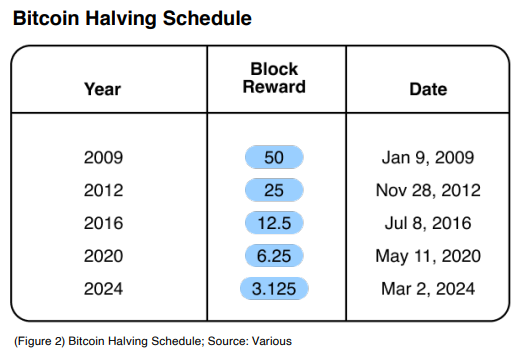

- In Q1 2024, another halving will occur which will reduce Bitcoin’s block reward by half.

- we assume 16.3M BTC is all that will ever be mined, not 21M.

- We find the immediate-term value of one Bitcoin to be $52,556, undervalued by 33% at current price.

- Bitcoin has been adopted on a global scale, making it the first cryptocurrency to take mass adoption.

- Bitcoin will become the de facto digital asset to hold as a percentage of an institutional portfolio.

- The next Bitcoin halving date is set to March 2, 2024.

Since inception, it is a textbook example of the Lindy effect – the longer an idea persists, the longer it will survive.

The protocol has global reach which is evidenced by robust user growth. Active address/wallet counts have been increasing by 22% year over year (YoY) since June 2018. We continue to see global adoption of the protocol and more usage over time.

Terahashes per second (TH/s), a measurement of mining power dedicated to mining Bitcoins, is at or very close to an all time high. Network participants are willing to invest in equipment and pay the power costs to contribute hashing power to mine Bitcoins. We think this is the ultimate endorsement of the network, as miners are increasingly willing to invest time and money over the long-term.

In our investment thesis, we assume a 1.76% supply inflation rate until March 2024, where inflation drops to .88% YoY due to the halving. We assume the 2024 Bitcoin halving takes place in March 2024. We also assume a total supply of 21M BTC and a current circulating supply of approximately 19M BTC.

I’ll Take Half

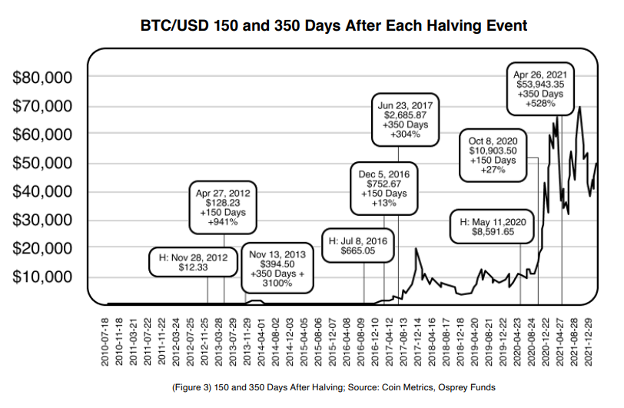

Bitcoin halving cycles decrease the output of Bitcoin for miners approximately every four years. For every 210k blocks that are mined, the block reward is halved. There have been a total of four halving events in Bitcoin’s life (2009, 2012, 2016, 2020). Usually after each halving event, we see that the issuance shock causes a delayed effect on the price of Bitcoin 150 and 350 days after a halving event occurs. On each of the halving events, the price has always been higher as a result.

Bitcoin was designed to target a block time of 10 minutes which means that rewards are distributed to miners every 10 minutes. The network specifically adjusts mining difficulty upward if the algorithm identifies that miners are solving mining problems too quickly.

Over the last 7 years, Bitcoin 90-day average block times have been cycling between 9 and 10 minutes caused by variances in network factors. This lowers overall average block times below 10 minutes and slightly decreases the time to each halving. The next halving will approximately occur in the beginning of March 2024; however this could vary slightly as time approaches this date.

We’ve mapped all relevant halving dates in the past showing prices 150 days and 350 days past the halving event. In every case, Bitcoin’s price in $USD has always increased 150 days out from the halving date. Heftier gains are made 350 days out from a halving event and have never dipped below 300% on a +350 day basis. In every case so far, the period after 350 days shows additional price increases that can also be captured.

NOTE: The next halving on approximately March 2, 2024. 150 days after this date is July 30, 2024 and 350 days after is February 15, 2025. We note the dates for reference – certainly nothing is guaranteed; however the idea generally aligns with our base, bull and bear price targets at the end of 2024.

Lightning, On a Chain

The Lightning Network is a separate layer from the base Bitcoin blockchain. It is a separate, decentralized chain based around the idea that two or more participants can open a payment channel between themselves but not broadcast their transactions to the main Bitcoin blockchain. First, users must deposit funds on the Bitcoin blockchain. Then they can transact on the lightning network if their transactions do not exceed their deposited amount.

As many payments can take place over the Lightning Network payment channel as desired where the transactions between participants are netted against one another. When the payment channel is closed by all or one of the participants’ choosing (there is no time limit), the underlying Bitcoin blockchain is updated with the net transaction number between the participants.

The Lightning Network makes promises to scale to billions of transactions per second; however we are still in the early stages and will need to wait to see how the technology develops. The Lightning Network now has enough nodes on the network with a capacity to process $160M worth of Bitcoin.

A Bit(coin) Risky

While Bitcoin brings stability backed by the largest collective mining operations, popularity across the world, and a deep crypto history, the network remains slow on a transaction per second basis.

Currently the network is processing transactions at a rate of 2 to 5 transactions per second. This is certainly the slowest layer 1 in comparison to other proof-of-stake competitors by a longshot. While there are ongoing efforts like the Lightning Network, during periods of heavy congestion, the network in its current form may become unusable and take over a day to process certain transactions, similar to what occurred in 2017.

There is also a risk that Bitcoin’s technology as the first cryptocurrency, although reliable, will be overtaken by technology that is at least just as stable and faster in the coming years. This is what many networks are trying to accomplish, but so far, Bitcoin’s dominance has not been challenged.

Other risks include an unforeseen exploit in the protocol, such as in 2018 when a security researcher found a memory vulnerability that could crash over half of all nodes on the network, including miners. The problem was kept secret until it could be fixed.

Get the Full Bitcoin Analysis Here

The aforementioned information is based on a study conducted by Osprey Funds’ Research Analysts. Any numbers regarding future events are outcome predictions, not factual data. We are not recommending that you invest in Bitcoin (BTC) based on the information contained here. Please use this data and information as assumption only.